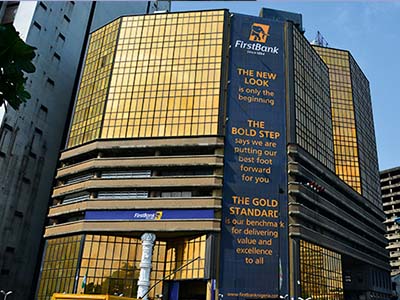

First Bank Holdings led a rally of Nigerian banking stocks on Tuesday, fuelled by hopes that Africa’s biggest economy will emerge from recession soon, dealers said.

First Bank Holdings, the parent company of Nigeria’s oldest commercial lender First Bank, rose 10.02 percent in early trade to 5.38 naira ($0.0171), a level last seen on Oct 10, 2015.

“The market as a whole is reacting to a favourable economic indication. Everybody is now saying the recovery has started, that the economy is on the path of growth,” said Rasheed Yusuf, a senior stockbroker.

“The shares of First Bank (are) currently on demand, nobody is willing to sell. We should expect this trend to continue for the next few weeks,” Yusuf said, adding that First Bank shares were valued cheaper than its peers.

United Bank for Africa (UBA.LG), was up 3.73 percent at 7.80 naira per share, Zenith Bank rose 8.63 percent to 20.78 naira.

The overall market index hit its highest in more than 10 months as investors responded to more favourable economic indicators, traders said.

The OPEC member country said last week it was moving out of recession after data showed its economy shrank a further 0.52 percent year-on-year in the first quarter, which was less than the revised contraction of 1.73 percent in the fourth quarter of last year.