Nigerian businesses are currenrly burdened more by monetary policy measures of the Central Bank of Nigeria, (CBN), followed by other fiscal measures that are threatening lives and livelihoods of the citizens, apex bank’s survey has shown.

The Business Expectation Survey (BES), conducted between June 16 and 20 with a sample size of 1,900 firms across various sectors, disclosed that high interest rates had a constraint index score of 75.6, marginally higher than insecurity and insufficient power supply with 75.2 and 74.3 scores.

Although the respondents cautiously expect the Naira to US Dollar exchange rate to appreciate across the review period, they also anticipated an increase in the cost of funds during the same period

Part of the survey says:

“Despite the prevailing optimism, firms identified significant operational

challenges to include: high interest rates, insecurity and insufficient power supply, which could potentially moderate future growth.

Business Expectation Survey (BES), conducted between June 16 and 20 with a sample size of 1,900 firms across various sectors, disclosed that high interest rates had a constraint index score of 75.6, marginally higher than insecurity and insufficient power supply with 75.2 and 74.3 scores.

Businesses point to these three factors as the major hindrances hurting profitability and limiting expansion in June.

“Respondents identified High interest rate (75.6), Insecurity (75.2) and

Insufficient power supply (74.3) as the top three business constraints in June

2025, highlighting concerns around factors that directly impact operational

stability and profitability.

At the bottom of the top ten were unfavourable political climate (62.5) and poor infrastructure (62.4).

This suggests that business constraints are more focused on economic and

financial risks than political challenges in the review period.”

Other constraints according to the survey report included “high taxes (73.2), financial problems (68.9), high bank charges (68.7), unfavourable economic climate (67.8), unclear economic laws (67.4), unfavourable political climate (62.5), and poor infrastructure (62.4).”

READ ALSO:FTS: Disquiet In Banking, Manufacturing Sectors Over Recapitalisation, Interest Rates

But CBN has continued to maintain a hawkish stance in a deliberate move to checkmate inflationary pressures and as well lure in dollar inflows, which will ultimately lead to accretion in the nation’s foreign reserves, with the attendant positive jmpact on the value of the naira.

Monetary authorities hiked key benchmark interest rates by a cumulative 875 basis points to 27.5 percent and have since held it steady for the fourth consecutive time, so as to have a firmer grip on the country’s inflation outlook and Exchange rate

Analysts and entrepreneurs have expressed disappointment wirh the recent outcome of rhe MPC meeting retaining rhw rates, noting that it portends lingering challenges in both banking and manufacturing sectors.

Already, the action has caused anxiety in the economy, burdened by decayed infrastructure, particularly, electricity, among others.

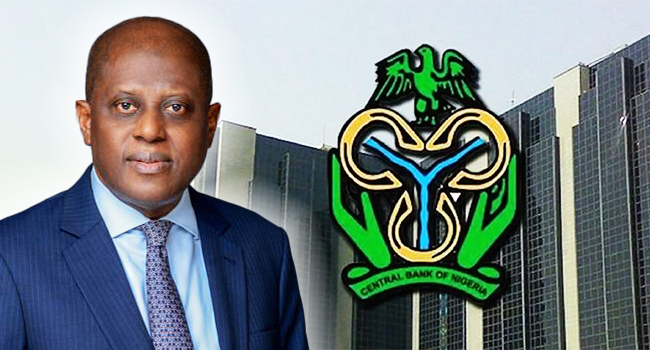

But, the firms cautiously remain optimistic as CBN Governor Olayemi Cardoso and the government continue to give hope.

The CBN’s June Business Confidence Index stood at 20.7 and is projected to rise to 41.3 over the next six months, driven by expectations of increased activity and better operating condition.

However, confidence varies by region: the South East posted the lowest score, 4.4, weighed down by high interest rates, while the North East showed the highest optimism, 37.1.

But, Cardoso continues to justify the need for a high interest rate in a volatile macroeconomic environment, adding that for the economy to survive these challenges, some drasric actions must have to be taken and transparently too.