After months of uncertainty and anxiety over the 2026 budget, the Federal Executive Council (FEC), on Wednesday finally endorsed the 2026-2028 Medium-Term Expenditure Framework (MTEF) for submission to the National Assembly.

Under the new policy framework released, the Federal Government is targeting 2.06 million barrels per day (mbpd) of crude oil production, even though the government has set 1.8 million barrels per day in the worst-case scenario, as well as a crude oil benchmark of $64 per barrel.

The medium-term fiscal plan also projects spending of around 54.5 trillion naira ($37.71 billion) with forecasts of total federal revenue at 34.33 trillion naira, leaving a 20.1 trillion naira deficit, or 3.61% of GDP, with debt service costs estimated at 15.9 trillion naira, Atiku Bagudu told reporters after a cabinet meeting in Abuja.

Nonrecurrent debt expenditure is set at 15.27 trillion, underscoring the fiscal strain on Africa’s most populous country.

The naira is projected at an exchange rate of ₦1,512 to $1 against the US dollar for the fiscal year.

READ ALSO:Angry Contractors Lay Coffin In Front Of Ministry Of Finance In Protest

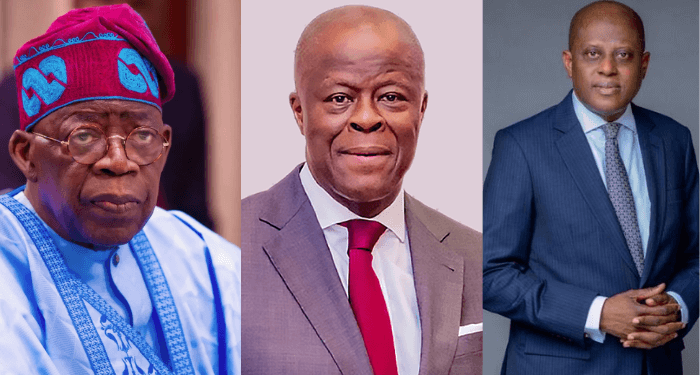

Atiku Bagudu, the minister of budget and economic planning, unveiled the framework after the Federal Executive Council (FEC) meeting, presided over by President Bola Tinubu, at the Presidential Villa, Abuja.

Bagudu revealed that the Council approved a crude oil production benchmark of 2.06 million barrels per day for 2026, while a more cautious figure of 1.8 million barrels per day will serve as the basis for budgetary planning.

He expressed confidence that with macroeconomic stability now taking root, it is imperative to sustain the ongoing reforms.

He noted that once the outlined measures are fully implemented, along with the Medium-Term Expenditure Framework and the Fiscal Strategy Paper, they will catalyse stronger and more sustained economic growth.

The federal government’s expenditure breakdown by major heads shows that statutory transfers will be around ₦3 trillion, debt service expenditure will be ₦10.91 trillion, and non-recurrent expenditure (personnel cost) will be around ₦15.27 trillion. The deficit is projected at ₦20.1 trillion, which is 3.61% of the estimated GDP.

The exchange rate assumption took into account the fact that 2026 precedes a national election year, noting that all parameters were drawn from extensive fiscal and macroeconomic analysis undertaken by the Budget Office and other relevant agencies.

In addition, the Federal Executive Council took comments and approved the Medium-Term Fiscal Expenditure Ceiling (MFTEC), which guides spending limits and helps ensure a disciplined budgeting process.

President Tinubu sought the endorsement of the National Economic Council (NEC) for enhanced vigilance across the Federation to curb revenue leakages arising from illegal activities in the oil and gas sector as well as in the exploitation of critical minerals.

He emphasised the need for substantial transformational investment in national infrastructure and urged renewed hope for infrastructure funding from both the federal government and constituents of the Federation, as well as measures to boost domestic production and diligent implementation of the renewed work development programme.