…Urges State House To Leave NNPCL Alone

Following the increasing inflation rate, Economy and Energy Expert, Kelvin Emmanuel, has advised the Federal Government to focus on economic drivers that will reduce inflation rate, in order to improve the cost of living of the average Nigerian.

Emmanuel gave the advice when he appeared as a guest on Channels Television’s The Morning Brief on Thursday.

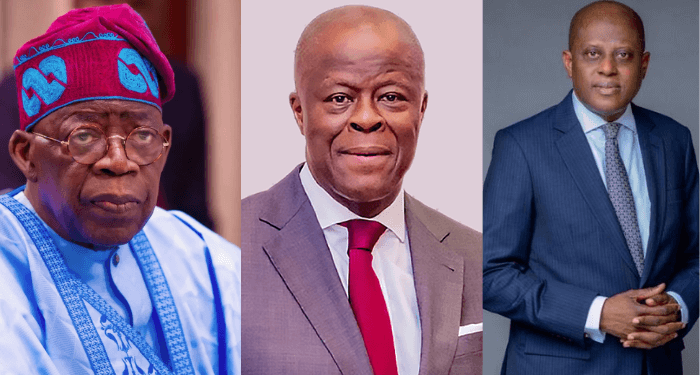

While speaking to the topic ‘The Economy Under Tinubu’, he identified three drivers of the economy as inflation, exchange rates and the interest rate, noting that the Central Bank of Nigeria and the FG were yet to address them.

“I will be fair to President Tinubu. Where was the economy when he came? There were some $7 million FX backlogs when he came in. CBN was technically insolvent even though they don’t like to acknowledge it, because they were in the negative territory when it comes to their net reserves.

“I will rate Yemi Cardoso 7/10 for the job they have done to restore confidence in the economy, and the fact that they have fought very hard against the Federal Government’s executive branch, not following the legacy of the late president Buhari of violating Section 38 of the CBN Act of Ways and Means.

“They have been under serious pressure to violate section 28, which says that the FG cannot borrow more than five per cent of real GDP from the previous accounting year as Ways and Means to finance budget deficits.

“Three primary areas drive the economy…Inflation, exchange rates and interest rates.

“That is why I don’t believe in the inflation numbers being brandished by the NBS. Those numbers are distorted. Even the MPC and the CBN have yet to react to it as expected.”

Nigeria’s headline inflation rate eased for the fourth consecutive month in July 2025, falling to 21.88 per cent from 22.22 per cent in June, according to figures from the National Bureau of Statistics.

The latest Consumer Price Index report revealed that the July rate was 0.34 percentage points lower than the previous month and 11.52 percentage points below the 33.40 per cent recorded in July 2024.

Food inflation stood at 22.74 per cent year-on-year in July, compared to 39.53 per cent in the same month last year.

Although the data confirm that headline inflation has continued to moderate on an annual basis, analysts are of the opinion that the persistent monthly increases underline the reality that the cost of living remains elevated for many Nigerians.

Emmanuel continued, “What Nigerians feel that affects their pricing and purchasing power is inflation. If inflation goes up, the interest rate has to be increased.

“If the interest rate isn’t increased, there is going to be a flow from naira-denominated to dollar-denominated assets, which will worsen inflation, and that affects the exchange rate.

“If the exchange rate increases, the duties paid at the ports will increase, and the duties will impact everything Nigerians import.

“The immediate concern for the Nigerian government should be how to bring down inflation so that the interest rate can be reduced, and then the cash reserve ratio can be adjusted, which is the highest we have ever seen in the history of Nigeria. Cash ratio went from 14 in 2014 to 50 per cent today, and there are rumours that the Monetary Implementation and Technical Committee might recommend that the MPC increase the interest rate further.

“The reason Nigerians on the street are not feeling the impact is because the inflation, interest and exchange rates are the drivers of the economy, which affects the per capita income of Nigerians, and the CBN is not focusing on buffers that will reduce them.”

Emmanuel also spoke to other economic challenges, such as the national budget, and those bedevilling the Nigerian National Petroleum Company Limited (NNPCL).

He also advised the State House to allow the state oil company to run its affairs independently as a company.

“I will continue to say it anywhere…The State House should leave NNPC alone to function as a business. There has been excessive control by the State House.

“Privatise NNPC and send it to the market, and sell IPOs and allow the market to run it, and collect your dividend and taxes.

“And I will also add that the value attribution on the NLNG has to be revisited…”

This is as President Bola Tinubu said on Wednesday that the Federal Government was no longer borrowing from local banks to buttress the strong fiscal performance since the start of the year.