The Central Bank of Nigeria (CBN) has said that it plans to pursue civil, administrative, or criminal sanctions against parties found to have breached foreign exchange (FX) rules, following the conclusion of a forensic audit into undelivered forward contracts.

Some analysts have commended the proposed action hy the apex bank, saying if it carries out the proposed action, more sanity would be restored into the foreign exchange market.

Besides, they further argue that the development is a practical demonstration of transparency and political will on the part of the Governor, in taking the bank to greater heights.

A document titled Frequently Asked Questions (FAQ) on the Settlement of Undelivered Forward Contracts, published on the Bank’s website on Thursday, revealed the development.

The audit, conducted by Deloitte from September 2023, reviewed transactions under the Retail Secondary Market Intervention Sales (RSMIS) window.

The document read, “The Central Bank of Nigeria is reviewing appropriate legal action against parties found to have violated applicable rules and regulations, based on the findings of the forensic audit. The Bank will collaborate with law enforcement and regulatory agencies to pursue civil, administrative, or criminal sanctions, as necessary.”

According to the apex bank, the contracts involved upfront naira payments in exchange for promised US dollar delivery on future dates—many of which went unfulfilled.

The CBN said the audit was necessary to verify the legitimacy of these contracts, protect FX reserves, and uphold regulatory standards.

The findings revealed extensive irregularities, including mismatches in beneficiary identities, exaggerated FX requests, use of incorrect or blank Form M submissions, and approvals for non-permissible imports.

The CBN noted that certain transactions were based on vague or false documentation, while others involved companies that lacked authorisation for the items they sought to import.

In several cases, the approved FX sale value exceeded the declared cost of the imported goods, raising questions of misrepresentation.

According to the CBN, such infractions rendered the contracts void under Nigerian law and ineligible for FX settlement. Only verified and compliant contracts were honoured.

The Bank clarified that the affected counterparties had been given the opportunity to respond during the audit process before any contract was invalidated.

For those deemed invalid, the naira previously collected was refunded, but no FX was disbursed.

READ ALSO:Ballon d’Or: Nnadozie, Madugu Nominated For Best Goalkeeper, Women’s Team Coach Awards

The CBN has declared the audit process closed and not open to appeal, citing the independence and procedural fairness of the review.

“The audit conclusions were based on a rigorous process carried out by an independent forensic expert (Deloitte), acting pursuant to a transparent mandate.

“The auditor contacted the authorized dealer banks concerning those contracts to get their explanations of the infractions before reaching conclusions on them.

The findings have therefore met procedural fairness standards. The case of undelivered forward contracts is now concluded and closed,” the document stated.

Earlier in March 2024, the CBN announced the complete clearance of the valid foreign exchange backlog.

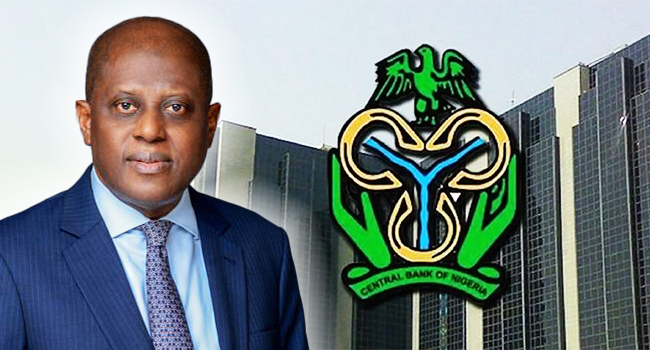

This was after the CBN governor, Olayemi Cardoso, in February, disclosed that about $2.4 billion foreign exchange backlog is not valid for settlement.

Cardoso clarified that out of the initially reported $7 billion FX liabilities of the federal government, about $2.4 billion were identified as invalid following a forensic audit by Deloitte Management Consultants.

Earlier report showed that CBN officially concluded the forensic audit into undelivered forward foreign exchange (FX) transactions and refunded the value of all unfulfilled and unvalidated deals to banks in naira.

The development was contained in a letter dated August 4, 2025, signed by Okey Umeano, the Acting Director of the Financial Markets Department, and addressed to all authorised dealer banks.

The letter noted that all validated transactions had been paid, while the local currency equivalent of outstanding and unverified transactions had been returned to the banks.