*Crude Oil Prices $63/Budget’s $75, Lowest Level Since 2021

*CBN Opens Dollar Tap To Save. Dwindling Fortunes Of Naira

*Tariffs To Negatively Impact Nigeria’s $6bn Annual Exports

*CBN Spends $669m To Defend Naira. In Q1, 2025-Report

*Naira weakens By 3%, Q1, 2025

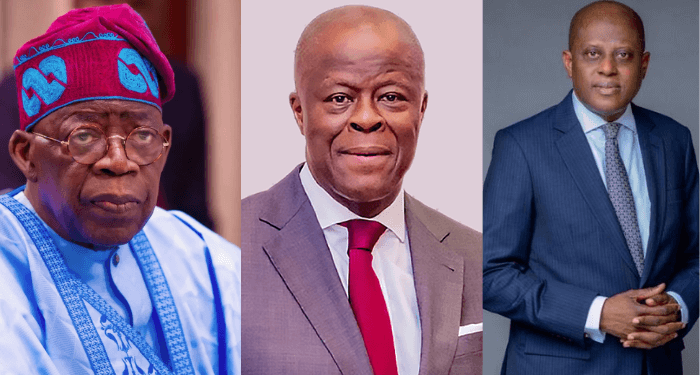

*Heightened Political, Security. Tension Worries Stakeholders

Nigeria’s 2025 budget is facing potential threats as crude oil prices slip below the 2025 budget projections of $75 per barrel.

The development is compounded by plans by the Organisation of Petroleum Exporting Countries and allies like Russia, known as OPEC+, to proceed with the planned May oil output increase.

Also, the heightened political and security tension may be responsible for the opening of dollar tap by Central Bank of Nigeria (CBN) in defence of Naira, amid dwindling fortunes of the local currency.

Though the fall in crude prices is good news to an average Nigerian as this could lead to cheaper petrol and diesel, but at the same time, gives the Federal Government sleepless nights as it threatens the 2025 budget revenue projections.

According to Reuters, Oil prices extended last week’s losses on Monday, with WTI falling more than 4%, as escalating trade tensions between the United States and China stoked fears of a recession that would reduce demand for crude.

ALSO READ:IGP Withdraws Invite To Emir Sanusi Over Death During Eid-el-Fitr Celebrations

Consequently, Brent futures declined $2.54, or 3.9%, to $63.04 a barrel at 0745 GMT, while U.S. West Texas Intermediate crude futures lost $2.5, or 4.03%, to $59.49.

Both benchmarks dropped their lowest since April 2021.

Oil plunged 7% on Friday as China ramped up tariffs on U.S. goods, escalating a trade war that has led investors to price in a higher probability of recession.

Last week, Brent lost 10.9%, while WTI dropped 10.6%.

“It’s hard to see a floor for crude unless the panic in the markets subsides and it’s hard to see that happening unless Trump says something to arrest snowballing fears over a global trade war and recession,” said Vandana Hari, founder of oil market analysis provider Vanda Insights.

Responding to U.S. President Donald Trump’s tariffs, China said on Friday it would impose additional levies of 34% on American goods, confirming investor fears that a full-blown global trade war is underway.

Imports of oil, gas and refined products were given exemptions from Trump’s sweeping new tariffs, but the policies could stoke inflation, slow economic growth and intensify trade disputes, weighing on oil prices.

Federal Reserve Chair Jerome Powell said on Friday that Trump’s new tariffs are “larger than expected,” and the economic fallout including higher inflation and slower growth likely will be as well.

Adding to the downward momentum, the Organization of the Petroleum Exporting Countries and allies (OPEC+) decided to advance plans for output increases.

The group now aims to return 411,000 barrels per day (bpd) to the market in May, up from the previously planned 135,000 bpd.

“This potential influx of supply, reversing cuts maintained over the past two years, represents a major shift in market dynamics and acts as a significant headwind for prices,” said Sugandha Sachdeva, founder of SS WealthStreet, a New Delhi-based research firm.

Over the weekend, top OPEC+ ministers stressed the need for full compliance with oil output targets and called for overproducers to submit plans by April 15 to compensate for pumping too much.

On the geopolitical front, Iran on Sunday rejected U.S. demands that it hold direct nuclear talks or face strikes. Russia claimed to have captured Basivka in Ukraine’s Sumy region and said its forces were attacking multiple nearby settlements.

CBN Opens Dollar Tap As New Tariffs Pressure Exchange Rate, Foreign Reserves

The Central Bank of Nigeria (CBN) is not taking chances, fearing that the new tariffs have the potential to dwarf and possibly erode achievements made so far at rhe foreifn exchange market as well as the foreign reserves components

As a proactive measures, CBN may have decided to open the dollar tap to curtail the emerging pressures, selling about $200 million to acredited dealers on the official market, Friday, as it stepped in to bolster liquidity following renewed pressure on the local currency.

Specifically, the apex bank intervened in the foreign exchange market with a $197.71 million sale to authorised dealers to chekmate the 2.3 percent depreciation in the local currency in the last three days.

Analysts, noting this was the CBN’s first “intervention” of the year, say it may signal the start of a series of actions if market conditions continue to deteriorate in the coming days.

The naira weakened by N35.77 at the official Nigerian Foreign Exchange Market (NFEM) between Wednesday and Friday, closing at N1,567.02 per dollar on April 4, compared with N1,531.25 on April 2, CBN data showed.

Worried that Nigeria relies on crude oil exports for 90% of its foreign exchange, and the emerging threats, CBN, in a swift reaction issued a circular on Sunday, saying, it has facilitated market activity on Friday, with the provision of $197.71 million through sales to authorised dealers.

According to the apex bank, the move is in line with its commitment to ensuring adequate liquidity and supporting orderly market functioning, adding that the measured step aligns with its broader objective of fostering a stable, transparent, and efficient foreign exchange market.

It noted recent movements in the foreign exchange market between April 3 and 4, 2025, “reflected broader global macroeconomic shifts currently affecting several Emerging Market and Developing Economies.”

“These developments were as a result of the recent announcement of new import tariffs by the United States government on imports from several economies, which has triggered a period of adjustment across global markets.

“Crude oil prices have also weakened – declining by over 12% to approximately US$65.50 per barrel – presenting new dynamics for oil-exporting countries such as Nigeria,” the statement said

Tariffs To Negatively Impact Nigeria’s Exports-FG

The Federal Government has raised concerns over the potential negative consequences of newly imposed U.S. tariffs on Nigerian exports.

The Donald Trump’s administration recently imposed a 14% tariff on Nigerian exports, stating its commitment to mitigating the impact while accelerating economic diversification.

In a statement signed by the Honourable Minister of Industry, Trade and Investment, Dr. Jumoke Oduwole, which was released on Sunday, the government noted that while oil has long dominated Nigeria’s exports to the US, non-oil products—many previously exempt under the African Growth and Opportunity Act (AGOA) now face potential disruption.

A tariff is essentially a tax imposed on goods entering a country. With this new 14% tariff, every $100 worth of Nigerian oil, for instance, will now cost U.S. refiners $114.

For Nigeria, this doesn’t just raise questions about trade, it raises alarm bells about revenue, inflation and cost of living, among others.

While providing the Federal Government’s first official response to the development, which has drawn widespread criticism from the European Union and various exporting countries, Oduwole emphasised that the newly introduced tariffs could undermine the competitiveness of Nigerian products in the U.S. market and disrupt business activities, particularly within the non-oil export sector.

“Nigeria’s exports to the United States over the past two years have consistently ranged between $5 billion and $6 billion annually,” she noted.

“Over 90% of these exports comprise crude petroleum, mineral fuels, oils, and gas-related products. Fertilisers and urea make up the second-largest export category, accounting for approximately 2–3%, while lead exports contribute around 1%—about $82 million in value.”

The minister added that smaller volumes of agricultural exports—including live plants, flour, and nuts—represent less than two percent of Nigeria’s total exports to the U.S.

She warned that non-oil products, many of which previously benefited from exemptions under the African Growth and Opportunity Act (AGOA), may now be adversely affected. The new 10% tariff on certain product categories could diminish Nigeria’s price competitiveness and restrict access to the U.S. market, especially for value-added and emerging sectors critical to Nigeria’s economic diversification.

“Small and medium-sized enterprises that built their business models around AGOA exemptions will now face increased costs and unpredictable buyer demand,” Oduwole stated.

She stressed that this challenge reinforces Nigeria’s commitment to boosting non-oil exports by improving quality assurance, control mechanisms, and traceability systems to align with global standards—ultimately enhancing the global acceptance of Nigerian products

CBN Spends $669 million To Defend Naira In Q1 2025

The Central Bank of Nigeria (CBN) deployed approximately $669 million in foreign exchange (FX) interventions during the first quarter of 2025.

A report by investment firm, AIICO Capital Limited, said the dollar sales totalling $668.8 million were to shield the naira from further depreciation.

The development comes amid dwindling dollar inflows and surging offshore demand for foreign exchange.

President Donald Trump’s sweeping tariffs are also rattling world’s market stability as stocks fell at opening on Monday.

The report also said that in a bid to stabilise the parallel market, the CBN also instructed Bureau de Change (BDC) operators to purchase $25,000 from authorised dealer banks at the official exchange rate.

ALSO READ;Naira Down To N1585/$ In Parallel Market

Despite these interventions, the country’s external reserves took a hit, reversing from a three-year peak of $43 billion due to debt service obligations and continued dollar sales to support the naira.

Nevertheless, the local currency came under significant pressure in March 2025, weakening in response to sustained demand in the Nigerian Foreign Exchange Market (NFEM). The naira depreciated by 2.97% over the month, sliding from ₦1,492.49/$ to ₦1,536.82/$ despite CBN’s dollar injections totalling $668.8 million.

The market opened the month at ₦1,510/$, with demand remaining elevated—particularly from foreign portfolio investors and local corporations. The parallel market reflected a similar strain, with the naira falling by ₦43.50 to close at ₦1,536.00/$.

Although mid-month liquidity saw a temporary boost from CBN interventions, demand continued to outweigh supply. By the end of the quarter, the naira remained under pressure, even with additional dollar sales and minor gains. On a quarterly basis, the currency posted a modest depreciation at the NFEM window, while external reserves declined to $38.31 billion.

Naira Weakens By 3% Q1, 2025

The local currency came under significant pressure in March 2025, weakening in response to sustained demand in the Nigerian Foreign Exchange Market (NFEM).

A report by investment firm, AIICO Capital Limited, said the naira depreciated by approximately 3 per cent over the month, sliding from ₦1,492.49/$ to ₦1,536.82/$ despite CBN’s dollar injections totalling $668.8 million.

The Central Bank of Nigeria (CBN) deployed approximately $669 million in foreign exchange (FX) interventions during the first quarter of 2025, according to the report.

The funds were to shield the naira from further depreciation amid dwindling dollar inflows and surging offshore demand for foreign exchange.

President Donald Trump’s sweeping tariffs are also rattling world’s market stability as stocks fell at opening on Monday.

The market opened the month at ₦1,510/$, with demand remaining elevated—particularly from foreign portfolio investors and local corporations. The parallel market reflected similar strain, with the naira falling by ₦43.50 to close at ₦1,536.00/$.

Although mid-month liquidity saw a temporary boost from CBN interventions, demand continued to outweigh supply.

By the end of the quarter, the naira remained under pressure, even with additional dollar sales and minor gains.

On a quarterly basis, the currency posted a modest depreciation at the NFEM window, while external reserves declined to $38.31 billion.

The report also said that in a bid to stabilise the parallel market, the CBN instructed Bureau de Change (BDC) operators to purchase $25,000 from authorised dealer banks at the official exchange rate.

Despite these interventions, the country’s external reserves took a hit, reversing from a three-year peak of $43 billion due to debt service obligations and continued dollar sales to support the naira.

Heightened Political, Security Tension Worries Stakeholders

Nigerians have expressed concern over rising insecurity as well as political tension in the polity, warning that they are capable of impacting negatively on the growth and development prospects of the country.

Also, the concerned stakeholders have called on the political elites and their supporters to guard against utterances and actions that could fan the embers of discord among Nigerians, arguing that they are discouraging both local and foreign investors.

ALSO READ:Shelve April 7 Nationwide Protest, Police Warn Organisers

Citing killings in the Middle Belt, particularly on the Plateau and Benue, the observed that youthful population that could be engaged on the farms are being wasted daily, a development that, they argue, would result in food insecurity, rise in unemployment and other social vices.

Besides, the pressures from the US hike in tariffs, they bemoaneed escalating insecurity, corruption and other blockage as major challenges facing the non-oil sector of the nation`s economy.

Agitations and threats of strike action by organised labour, civil society organisations, and.itjwr interest groups, they further argue ate distracting government, that is facing widening gap between it and the citizens on account of rising poverty.