Concerns are being expressed as to how Open University of Nigeria (NOUN) Microfinance Bank, under the supervision of the Central Bank of Nigeria (CBN) was allowed to degerate into an institution whose ownership is being contested despite approval by the regulatory authorities.

A source close to the management of the bank told metrobusinessnews.com (MBN) that the crisis in the bank is an offshoot of the bigger problems in the institution.

But analysts are worried that CBN, with off-site and on-site supervision, rendition of quarterly reports to its own department, Banks and Other Financial Institutions (BOFID), could not notice the uneasy calm in NOUN over the control of the institution’s microfinance bank, that was supposed to be the pride of the federal government institution.

NOUN MFB was incorporated on March 2, 2009, and granted an operational licence by CBN on 3, August 2009 as Kelmaid MFB. It changed its name to Summit MFB with the Corporate Affairs Commission’s (CAC) approval on 10 August 2010 and eventually started business on February 9, 2011, in Abuja.

Since its inception, however, the bank’s performance has been abysmal, ocassioned by huge operational losses incurred over the years.

Sources close to the institution further say the crisis in the bank as well as the university is worsened by political interferance in the operations of the university with consequential effects on its subsidiaries.

“Part of the problem is as a result of the overbearing influence of political appointees as well as meddling into the operations of the institution by senior officials of the ministry and other related supervisory agencies.

Besides, the unwilthy ownership and management structures of the the bank did not help matters as they existed in the bank competing and conflicting interests, ” says a source.

The ownership of the bank comprises the university, the cooperative society, the owner of Spectrum Engineering, Isa Abubakar, the Owner of Tanadi Investment Ltd and former Vice-chancellor of the school, Samaila Ado Tenebe, and Integrated Facility Management Services Limited.

ALSO READ:Paris AI Summit Draws World Leaders, CEOs Eager For Technology Wave

There are also a few other stakeholders whose interests are inconsequential or non-verifiable.

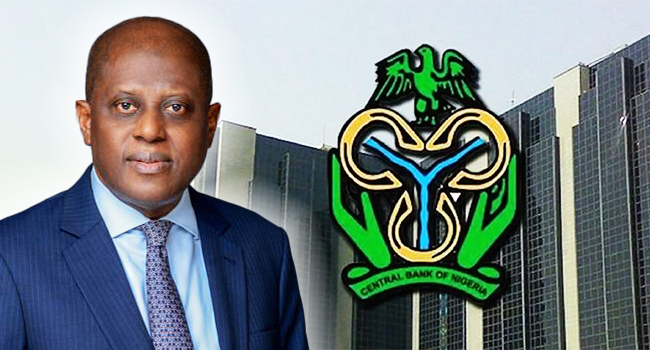

Although other sources attributed the festering crisis in the bank to what they regard as ‘lack of effective supervision and compromising stance’ by the administration of former Governor of CBN, Godwin Emefiele, they were quick to add that one year was good enough for the present Yemi Cardoso administration to have waded into the rot and by now taken decisive action.

“The directors and other senior officials of the bank (CBN) should be held responsible

This is why some of us support the alleged restructuring in CBN, because most of them took advantage of the loose monitoring and supervisory laxity that had existed in the bank for almost a decade to perpetuate their acts,” says another source.

Isa Yuguda, former governor of Bauchi State and chairman of APC professionals is presently the chancellor and chairman of council.