John Danjuma Omachonu

Nigeria’s fiscal and monetary policy may be moving towards working at cross purposes as government’s economic managers and planners confront prospects of bigger liberalization aimed at increasing consumer spending with the attendant rise in consumer prices converging on plummeting growth rates.

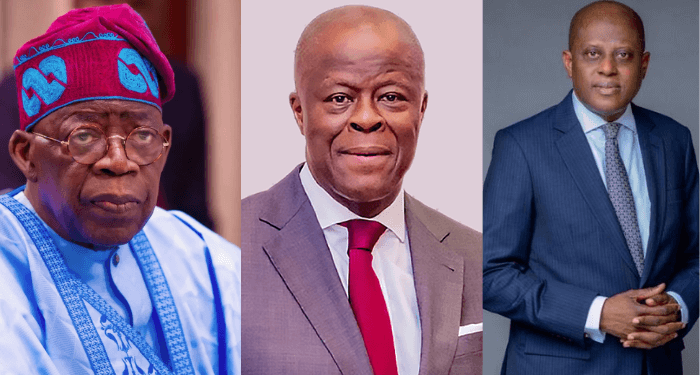

At the inception of Bola Tinubu administration the government announced an end to the controversial subsidy on petrol, unification of the exchange rates, and other measures encapsulated in his Renewed Hope Agenda for an expansionary budget, designed to stimulate economic activity.

Since the beginning of the year, the Monetary Policies of the Central Bank of Nigeria, (CBN) had maintained hawkish stance with the hiking of the bench mark interest rate, the Monetary Policy Rate (MPR) by 750 basis points to 26.25 percent in May, 2024, up from 18.75 percent in July 2023, essentially to tame the rising inflation, currently at 33.95 percent as at May and food inflation at over 40 percent.

While CBN has promised to be focused on its core mandate of price stability, maintaining a stable exchange rate and of course, economic growth, using the instrumentality of the orthodox monetary policy, the much needed synergy from the fiscal policy measures may be lacking, a development that .may however force the Monetary policy Committee (MPC) of CBN to continue tightening even as the real sector operators continue to struggle for survival, amid growing poverty and hardship.

Specifically, some analysts say current moves to save the economy through, for instance, the 150-day duty-free import windows for rice and other products, palliatives, among others have not addressed the basic challenges of insecurity as well as provision of infrastructure.

They wonder why federal government that declared emergency on food security since July 2023, with a 12-point agenda, decided to wait, almost, one year later, before thinking of mass importation, when it contributed in mopping up food from the market, under the guise of distributing palliatives to citizens.

They also fault government for not being truthful with the citizens on the situation of the nation’s strategic reserves, as it is now clear to the public that there are no reserves after all, even as corroborated by the Senate.

CBN governor,Yemi Cardosos, had in March identified government’s purchase of food items from the markets and distributing same to the citizens as part of the contributory factors to the rising inflation.

With farmers allegedly suffering post-harvest loss of about 70 percent due to lack of storage facilities and motorable roads to move the produce to urban areas and coupled with the heightened insecurity that have prevented farmers from accessing their farms, inflation and particularly, food inflation will continue to be on the rise.

According to professor Ken Ife, the issue of food inflation is now in the domain of fiscal policy space, arguing that rather than government importing rice, it should consider importing paddy rice so as to strengthen production system and as well save jobs.

Ike, who spoke on the Arise Television’s The Morning Show, program urged government to be bold enough to seek for help, even from the neighbouring countries.

According to him, this could be in the form of government going into production contract with these countries to produce and import to the country.

ALSO READ:It’s Unconstitutional For Govs To Hold LG Funds, Supreme Court Declares

The professor further argued that there is need for government to live up to its responsibilities by tackling insecurity, flooding and also shifting attention to the Southern part of the country where there is expanse of uncultivated land.

Femi Oke, chairman, All Farmers Association of Nigeria,(AFAN), South West, blamed government for lack of activity in the Bank of Agriculture,which he said is lying ‘fallow and analogue.’

Oke, who spoke on Channels Television’s Morning Brief program said the meagre N150,000 to startups cannot go anywhere even with over 70 percent post harvest losses.

According to Friday Ameh, Lagos based analyst, CBN’s Monetary policies typified by rate hikes that have put manufacturers and citizens on edge, seems not in synergy with Federal Government’s proposed boosting of the economy and consumer spending through upward review of salaries and wages for workers, massive importation, and other reflating measures of the economy.

The analysts are unanimous in their submissions that the much hyped synergy between the monetary and fiscal policy must go beyond pronouncement to real action the current efforts to contain inflationary pressures would not need the needed results until the government moves beyond rhetoric and be intentional in its policy decisions and implementation with adequate supervision, monitoring and accountability.

With inflation not likely to abate possibly due to massive importation, insecurity, flooding and the planting seasonal impact, the forthcoming MPC meeting may be subjected to various arguments and counterargument either for or against further rate hike.This is even as the general opinion by most analysts is that the meeting might soft pedal on further rate hike, for which almost all the 12 members were favourable disposed to in the past three meetings held this year.