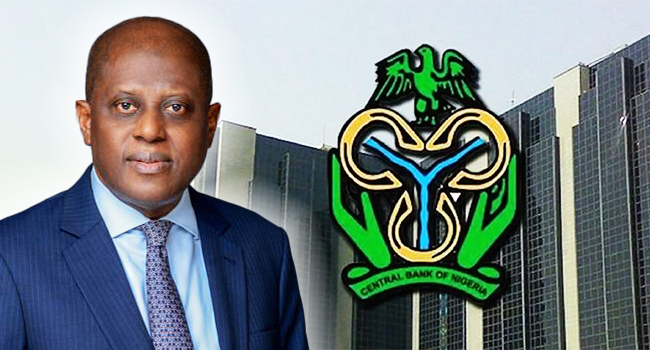

Monetary Policy Committee (MPC) member, Aloysius Uche Ordu has advised the Central Bank of Nigeria (CBN) to look beyond the conventional monetary policy measures in tackling the menace of the inflationary pressures that have eroded the purchasing power of the citizens.

In his personal statement to the last meeting, Ordu said reducing the country’s high inflation is both an economic and a political imperative of the first order.

At the meeting, the committee raised the Monetary Policy Rate (MPR) by 150 basis points to 26.25 percent, the points recommended by seven members of the 12 member committee,

But, Ordu, who was among the five that recommended 100 basis points said, “Clearly, monetary policy ought not be the only game in town for the express purpose of stabilizing Nigeria’s macroeconomy. An activist fiscal policy stance is urgently needed to bring inflation down quickly and painlessly. Besides, another substantial increase in the policy rate in May 2024 may raise market expectations both about the risks of inflation — because the MPC is so concerned about it — and market expectations about the ultimate expected tightening that we intend based on a balanced view of the evidence presented by CBN staff. Taking all the available evidence into account, my own preference was for a moderate increase in the MPR at this meeting. We need to continue to urge patience and to let our restrictive policy stance do its work.”

ALSO READ!

Contributing further, he sad, “Reducing Nigeria’s high inflation is both an economic and a political imperative of the first order. The MPC acted promptly and decisively during the February-March meetings, deploying the blunt instrument of excruciatingly tight money. Press coverage showed that the current state of play is wreaking havoc on consumers, particularly those on the lower end of the income scale who are more acutely feeling the pain from high inflation. This segment of our society is facing a myriad of challenges, including food and fuel, and they are financially strapped.”