For most of the analysts that spoke with metrobusinessnews.com (MBN), the ability of the Central Bank of Nigeria (CBN) to reign in inflation to bolster growth is becoming a near impossibility Inspite of astronomical iIncrease of interest rates since this year.

.

Since the resumption of the Monetary Policy Committee (MPC) meeting this year, interest rates have increased from 22.75 per cent in February to 26.25 per cent in May – a total increase of 750 basis points.

The analysts have argued that when interest rates are high, manufacturers, and contractors, among others, find it difficult to borrow, and by implication, low productivity occasioned by job losses.

‘With CBN’s anchor rate at 26.25 percent and banks charging above 30 percent, where do you expect manufactures and entrepreneurs, reeling under difficult operating environment to get enhanced return on investment that will enable them pay the interest rate,” queries an analyst.

Also, the World Bank has said that the tightening of the monetary policy by CBN, will not address inflation in the country.

The Bretton Woods institution disclosed this in its global economic prospects report.

The tightening of the monetary policy rate (MPR) is an increase in interest rate to control soaring inflation.

However, World Bank said one of the risks of Nigeria’s economic growth is the failure to tighten policies on inflation.

The World Bank in its latest report noted that: “Risks to Nigeria’s growth outlook are substantial, including the possibility that the tightening of monetary policy stops short of reining in inflation.”

The report also predicted Nigeria’s economic growth rate outlook for the rest of 2024 and 2025 to remain the same. “Growth in Nigeria is projected to pick up to 3.3 per cent this year and 3.5 per cent in 2025,” the World Bank said.

ALSO READ:MultiChoice Posts Loss On Drop In Subscribers, Weak Local Currencies

“After the macroeconomic reforms’ initial shock, economic conditions are expected to gradually improve, resulting in sustained, but still-modest growth in the non-oil economy.

“In addition, the oil sector is expected to stabilise as production somewhat recovers”, it stressed.

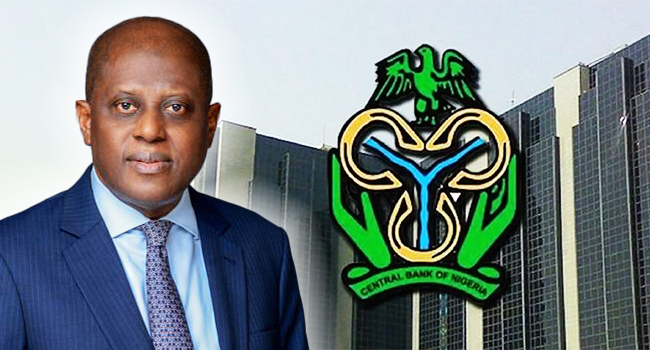

The fears were further highlighted recently by CBN Governor and Chairman of the MPC, Olayemi Cardoso in his personal statement when he argued that, “If such a hyperinflationary scenario is to become reality, available options to control inflation could be severely constrained.”

Cardoso noted that the facts presented to the MPC clearly indicate that the monetary factors contributing to inflation are diminishing in significance.