Written by: Jeremiah Ajayi

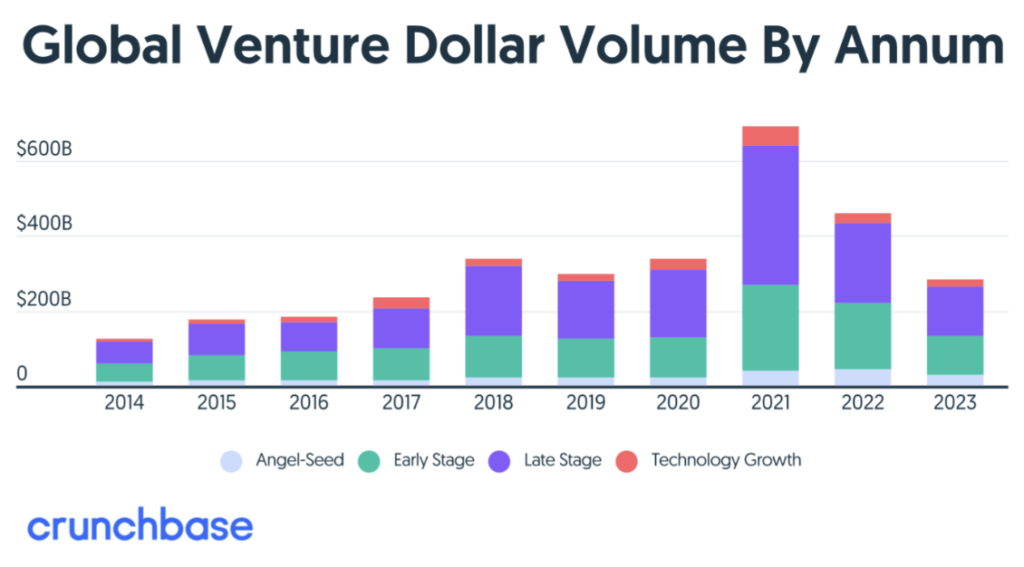

CAPE TOWN, South Africa, 26 February 2024, /African Media Agency/- In 2023, global venture capital investment experienced another lackluster year, reaching a modest $285 billion. This marked a significant 38% decline year over year (YoY), plummeting from the $462 billion invested in 2022.

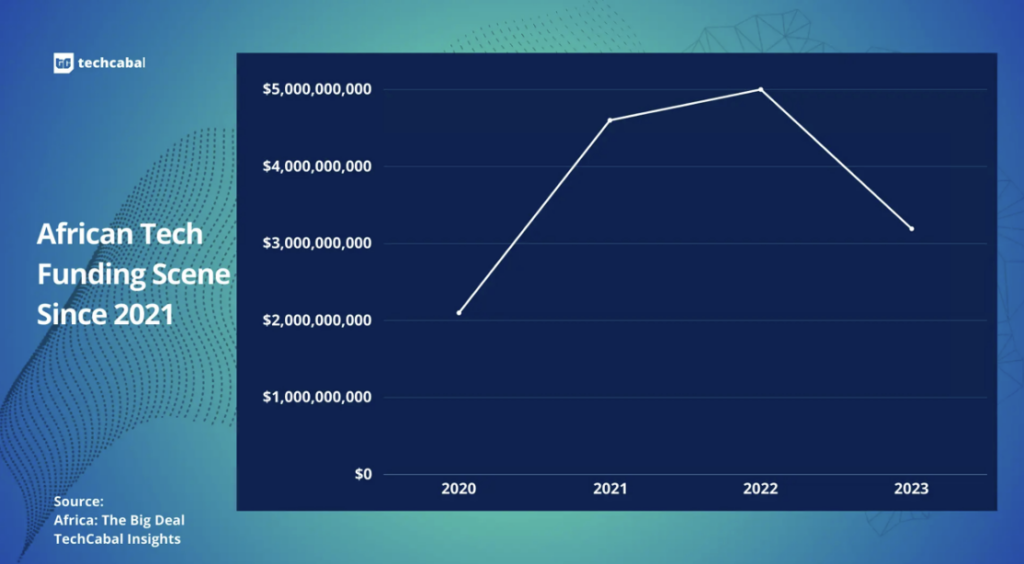

Despite Africa’s resilience in 2022 when the downturn commenced, the continent was not immune to the funding challenges of 2023.

According to Africa: The Big Deal, a curated funding database, African startups secured $3.4 billion in 2023, representing the lowest funding since 2020’s $2.1 billion. As anticipated, fintech dominated this funding, comprising 45% of the total capital raised, approximately $900 million.

The ongoing deceleration, referred to by some as the “VC Deep Freeze,” shows no signs of abating soon. Forecasts from TechCabal, ThomasVentures, and QED Investors anticipate a continuation of cautious spending, leaner startups, and challenging economic conditions, at least through the first half of 2024.

Despite this somber outlook, select investors at the African Fintech Summit 2023 remain cautiously optimistic, identifying opportunities amid the current slowdown.

Consolidation as a silver lining

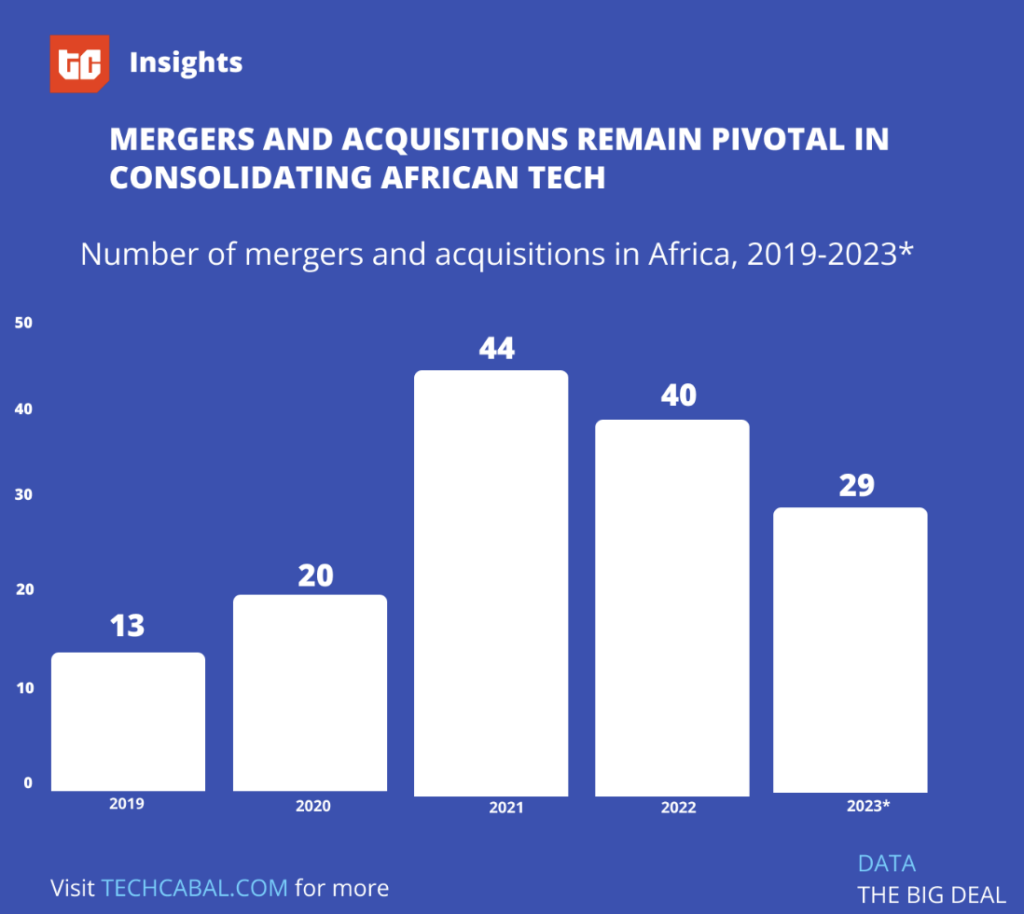

Consolidation, involving the amalgamation of different companies through mergers and acquisitions (M&A), emerges as one of the positive outcomes of the current investment slowdown.

Speaking at the panel on “Investing in Fintech Amidst a Global Investment Slowdown,” Philani Mzila, Investment Manager at Founders Factory Africa, notes, “I see the current market slowdown as a significant opportunity for consolidation. There are numerous business models that share similarities across different regions. This presents an opportune moment for well-prepared companies with strong management teams to pursue acquisitions, whether for expanding their geographic reach, introducing new products, or integrating new teams. Overall, I view this slowdown as a chance for growth”

Philani’s projection seems to be materializing. In 2023, there were 29 tech M&A deals, with Biontech setting the trend by acquiring AI firm Instadeep for $680 million.

Given the current market dynamics and reduced capital injection, such deals are expected to increase in 2024 as numerous early-stage companies struggle to survive independently.

Realistic valuations and the emphasis on profitability

The downturn in 2023 led to valuation revisions, impacting companies like Chippercash and 54Gene (which eventually ceased operations). With 2024 projected to be another year of VC Deep Freeze, valuations are expected to further reach historic lows, shifting the focus to unit economics and profitability.

Philani supports this prediction, stating at the Africa Fintech Summit, “The current state of affairs appears to be exceptionally beneficial for the ecosystem. A rationalization of the valuation curve and the availability of well-priced opportunities are crucial for fostering a Philani supports this prediction, stating at the Africa Fintech Summit, “The current state of affairs appears to be exceptionally beneficial for the ecosystem. A rationalization of the valuation curve and the availability of well-priced opportunities are crucial for fostering a stronger ecosystem, and I see this as a positive development. Despite the short-term challenges, I believe we will witness long-term successes.”

Ambitious solutions by ambitious founders

Historically, adversity has given rise to some of the most successful tech companies, exemplified by WhatsApp’s founding in the aftermath of the 2008 financial crisis.

Similarly, despite the challenges of 2024, the ecosystem is expected to be fertile ground for ambitious solutions crafted by visionary founders. This cycle is projected to yield potential exits, increased capital infusion, and breakthroughs for the ecosystem.

Dolapo Agbaje, Director at Apis Partners, encapsulates this sentiment, “Even as VC funding may experience ups and downs, the underlying pain points remain. Ambitious founders continue to actively seek solutions for these challenges. As long as there are persistent pain points and ambitious entrepreneurs eager to address them, opportunities will abound. The presence of opportunities, in turn, attracts capital.”

Conclusion

The turbulent landscape of global venture capital investment in 2023, marked by a substantial decline, has not left Africa unscathed. However, amidst the “VC Deep Freeze,” a silver lining emerges in the form of consolidation, as companies strategically navigate through mergers and acquisitions.

The shift towards realistic valuations and a heightened emphasis on profitability reflects a maturing ecosystem, offering well-priced opportunities for growth.

Despite the short-term adversities, the resilience of ambitious founders and their pursuit of innovative solutions position the African tech ecosystem for potential successes, exits, and breakthroughs in the coming years.

Distributed by African Media Agency in partnership with Africa Fintech Summit

About Africa Fintech Summit

AFTS is the premier global initiative dedicated to the African fintech ecosystem. Traditionally hosted in Washington, D.C., each April during the World Bank/IFC annual meeting week and a different African city each November (most recently in Lagos, Addis Ababa, Cairo, Cape Town, and Lusaka), the summit now adopts a hybrid format, offering both in-person experiences at the selected venue and virtual access to a global audience.

Supported by an advisory board of thought leaders and fintech pioneers, AFTS is a unique space where innovative ideas are debated, investments mobilized, partnership deals signed, and collaborations formed across sectors and geographies. The summit is co-organized by two Washington, D.C.-based firms, Dedalus Global, a strategic advisory group, and Ibex Frontier, a Pan-African consultancy advisory firm.

Learn more about the Africa Fintech Summit

Media contact:

Charles Isidi

Head of Marketing and Communications,

Africa Fintech Summit.

charles@africafintechsummit.com

The post The Positives of the VC Deep Freeze for African Tech: Consolidation, Realistic Valuations, and Ambitious Solutions in 2024. appeared first on African Media Agency.