Nigeria’s biggest bank by revenue expects lending to accelerate and bad debts to drop this year as growth in Africa’s largest economy picks up.

Nigeria’s biggest bank by revenue expects lending to accelerate and bad debts to drop this year as growth in Africa’s largest economy picks up.

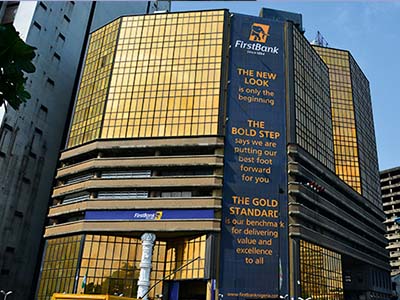

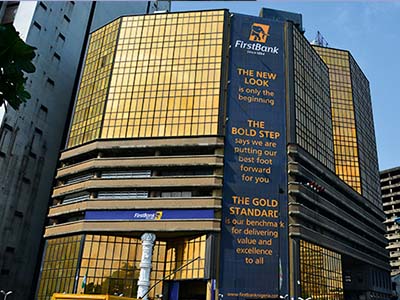

“The current macro environment is supportive of loan growth,” Adesola Adeduntan, the chief executive officer of FBN Holdings Plc’s First Bank of Nigeria, said in an interview in Lagos on Wednesday. After expanding less than 10 percent in 2017, growth in the company’s loan book will be “much better” than the second half of last year, when it already started showing signs of improvement, he said.

Non-performing loans as a percentage of total credit will “continue to trend downward” after declining to 20 percent in the nine months through September from 26 percent in 2016, helped by recoveries and write-offs, Adeduntan said. The bank is targeting an “improved performance” in revenue and profit in 2018, he said.

FBN is seeking to capitalize on an improved economic outlook in the continent’s biggest oil producer by “aggressively” rolling out agency banking this year and strengthening digital platforms to boost fee and commission income, Adeduntan said. Agency banking allows lenders to use third parties to take small deposits and offer other services.

Nigeria’s government is boosting spending to improve infrastructure and support a rebound in the economy after it contracted in 2016 for the first time in a quarter of a century, mainly because of a slump in oil prices. The improvement came after crude output and prices rose and authorities increased the supply of foreign currency needed by manufacturers to import supplies, helping to end a crippling shortage of dollars.

“As GDP growth continues, then the opportunities to do more banking or transactions will improve,” Adeduntan said. First Bank plans to increase lending to companies in manufacturing, agriculture and consumer-goods industries, he said.

After more than doubling in 2017, FBN’s shares have climbed another 31 percent this year. That compares with a rise of 11 percent for the Nigerian Stock Exchange All Share Index and 20 percent for the banking index. FBN trades at 0.7 times its book value, which is less than rivals such as Guaranty Trust Bank Plc and Zenith Bank Plc, which trade at 2.5 times and 1.3 times respectively.

Source: bloomberg