The Democratic Front (TDF) is convinced that President Bola Tinubu’s pro- business mindset will open up Nigeria’s oil industry for new investments after decades of little or no investment.

It said this against the backdrop of the resolution of the long standing-dispute between the Nigerian National Petroleum Corporation NNPCL and Seplat Energy Plc over its acquisition of the divested 100% share holdings in Mobil Producing Nigeria Unlimited (MPNU).

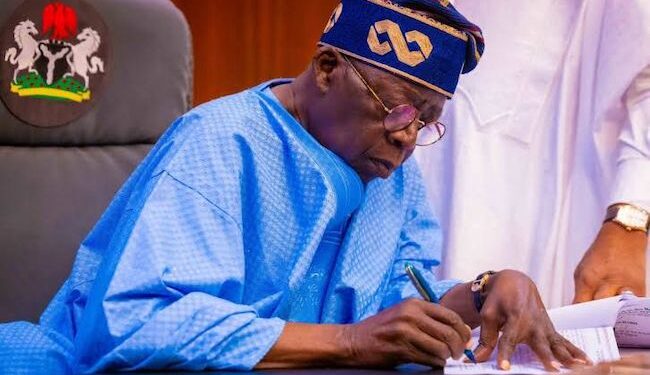

In a statement signed by its Chairman Danjuma Mohammed and Secretary Wale Adedayo,the group noted that until the President’s intervention, the dispute was costing Nigeria millions of dollars daily in lost revenue.

TDF said: “It is our pleasure to thank President Bola Tinubu for his timely intervention in the long-standing disagreement between NNPCL and ExxonMobil over the divestment of a 100% interest in Mobil Producing to Seplat Energy Offshore Limited.

“Although, we are saddened that the two-year long stalemate cost the nation a record loss of nearly $40bn at a conservative rate of $80 per barrel, we find solace and a renewed hope in the dexterous intervention of the President in resolving the disagreement between NNPCL and the domestic oil giant.

“We are also elated that the move is bound to increase Nigeria’s daily production volume by 480,000 barrels per day which will take the country’s total output to about 2 million bpd, a development that will put Nigeria in an enviable position on the African crude oil production index.

“We observe with delight that the Upstream sector of Nigeria’s Petroleum Industry has witnessed tremendous progress and patronage from the International Oil Companies (IOCs) since the coming to power of President Tinubu in May 2023.

“Our conviction remains that the current upward movement in the oil sector is the direct result of the President’s investment friendly policies.

ALSO READ:GPP Launches Innovative Machine, Pledges To Curb Capital Flight

“We note with joy that the President’s decision to domicile the crude oil sales account with the Central Bank, the appointment of capable hands to manage and regulate the oil sector, in line with the Petroleum Industry Act (PIA), and his ongoing efforts to resolve the age long Malabu oil crisis on OPL 245, which covers a defined deep-water offshore area of over 1000 m bsl worth $1.3 bn, are some of the attractions that have triggered the flurry of divestment of interests among IOCs from onshore to offshore operations in recent time thereby availing domestic oil producing companies the opportunity to substantially add to the national production stocks.

“We are happy to acknowledge and commend President Bola Tinubu for introducing far reaching reforms and measures that are aimed at returning the hitherto disorganized oil sector to sanity and global best practices.

“It is a great feat to see that concerted efforts by the President and his economic team have so far attracted an expected investment of $20bn from the IOCs, as reported recently by the Minister of State for Petroleum Heineken Lopkobiri.”

TDF urged the President to continue to deploy deliberate policies and actions that would galvanize the oil sector and others towards realizing the country’s full economic potentials.