The US Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole symposium on August 22, 2025 has signaled a high likelihood of an interest rate cut in September, citing shifting economic risks, a cooling job market, and easing inflation.

This led to a drop in the US dollar’s value against major currencies, with markets pricing in over 90% odds of a 25-basis-point cut.

For Nigeria, an emerging market economy heavily reliant on oil exports, dollar-denominated debt, and foreign capital inflows, this development has mixed but predominantly positive short-term implications.

Specifically, the dollar fell on Friday after Powell pointed to a possible rate cut at the central bank’s September meeting but stopped short of committing to cutting interest rates.

“While the labor market appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising. And if those risks materialize, they can do so quickly,” Powell told an audience of international economists and policymakers at the Fed’s annual conference in Jackson Hole, Wyoming.

Consequently, the dollar index , which measures the greenback against a basket of currencies including the yen and the euro, was last down 0.43% on the day at 98.18, after trading around 98.7 before Powell’s comments.

The euro gained 0.51% to $1.1664. Against the Japanese yen , the dollar weakened.

Some analysts see potential strengthening of the Naira, as a weaker US dollar typically reduces pressure on the naira, which has been depreciating amid high inflation and foreign exchange shortages.

According to them, lower US rates could encourage capital inflows from investors seeking higher yields in emerging markets like Nigeria, helping stabilize or appreciate the naira.

However, they were quick to observe that should the global risk aversion rises, typified by a US slowdown), volatile outflows could exacerbate naira weakness.

Recent data shows Nigeria’s inflation easing to 21.88% in July 2025, which might give the Central Bank of Nigeria (CBN) room to cut its own rates in response, further supporting the local currency.

Besides, they say Fed rate cuts make US assets less attractive, driving investors toward higher-return opportunities in Africa, including Nigeria resulting in possible increase in foreign direct investment (FDI) in sectors like energy, infrastructure, and technology, as well as portfolio inflows into Nigerian bonds and equities.

Africa-wide projections suggest such shifts could enhance liquidity and support growth, though Nigeria’s structural issues (e.g., fiscal imbalances) might limit the benefits if not addressed urgently.

Nigeria holds significant external debt of over $40 billion as of mid-2025, much of it in dollars. A weaker dollar and lower global borrowing costs from the Fed cut could reduce debt servicing expenses, freeing up fiscal space for domestic spending on infrastructure or social programs.

This is particularly timely, as high global rates have strained Nigeria’s budget in recent years. African governments, including Nigeria’s, could see alleviated debt pressures, but sustained fiscal discipline is needed to avoid over-borrowing.

READ ALSO:Nigeria : Economic Reforms And The Response So Far

Similarly, a depreciating dollar often boosts global commodity prices, including oil, Nigeria’s primary export , accounting for a very significant foreign earnings.

On the flip side, they added that a weaker dollar might make Nigerian non-oil exports, such as agriculture, less competitive in the US market. Broader global demand stimulus from the rate cut could help, but Nigeria’s 2025 economic outlook remains challenged by expected oil price declines of about $6 per barrel, potentially offsetting some gains.

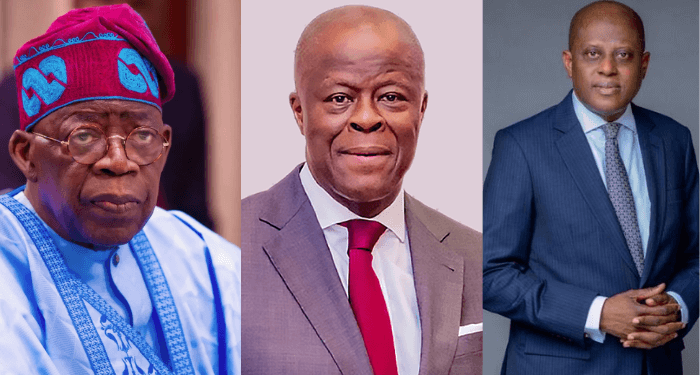

In his recent article, Economic Reforms And The Response So Far, Victor Ogiemwonyi, a retired Investment Banker, said:

“Nigerians are divided on the current reforms by the government. The critics think there is nothing good about it, they point to the economic hardship in the land and the suffering of majority of Nigerians, exasperated by the continuing insecurity, that is also threatening food security, because people can not go to their farms, and can not grow food. This has contributed to the increased food inflation, that has refused to come down, a key component of the core inflation figure.

They also point to the continuing corruption and the waste in Government, that no one is addressing. These are all genuine complaints. But it must be put in context of where we are coming from. The severity of the current economic hardship is a result of the delay in doing the needful.

Governments in the recent past, refused to take the hard decisions on the needed reforms. Imagine, if the two major reforms embarked on by the current government, was undertaken much earlier, getting rid of the ruinous fuel subsidies and aligning the Naira with the market, the billions spent propping up the Naira would have gone into our foreign reserves and would have become the backbone of support for the Naira, instead of the waste it was put to. Fuel subsidy was another savings that could have been made and invested in infrastructure. These two policy reforms, were also the source of the largest corruption in the economy. The delay in this policy reforms, is responsible for the current hardship in the land. The harshness, in its impact, is also linked to how long it took to come to the conclusion, that there was no alternative to these reforms. The fuel subsidy had to go and the Naira alignment, needed to be put in place.

The stable economic environment, we are beginning to see, with Naira stable and inflation slowing, is what has allowed businesses to make longterm plans. Underneath these improvements are the lowering petrol prices, that is propelling the domestic economy , and lowering the inflation pressure….We are also now finding breathing space with the improvement in Oil production going up, currently at 1.5m Barrels per day. This will make up for the current low prices, in the international oil market.

The economy’s positive current balance of

Patience Will Be Required, For The Reforms To Take hold, And Yield the Relief The Economy Needs.

Government must however, focus on continuing with the needed reforms. It must devote full attention to electricity and they provide the energy needed to power the economy. They should also focus on fighting corruption that has corroded all aspects of our lives….There must be an attempt to cut the huge waste we ordinary people see everyday, around Government. A wasteful and corrupt Government will not let the economy achieve its potentials.

Finally, nothing beats, a Government that starts out with sincerity of purpose. The people will forgive mistakes, if the purpose is seen to be sincere.”