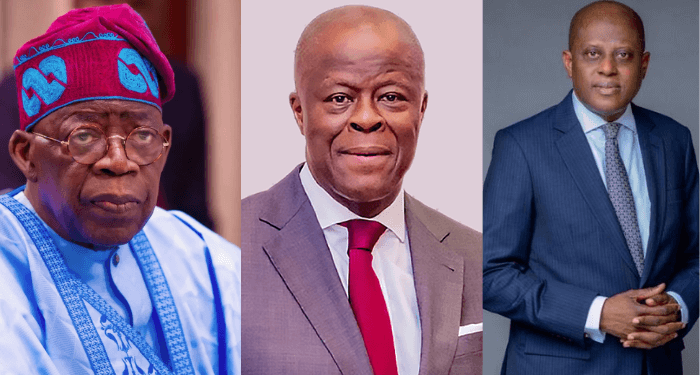

The Federal Government has confirmed plans to raise the Value Added Tax (VAT) rate to 15%. Minister of Finance and Coordinating Minister of the Economy, Wale Edun, disclosed this while speaking at an investor meeting during the ongoing IMF/World Bank Annual Meetings in Washington DC. Edun emphasized that the hike will largely target luxury goods. Edun explained that a bill currently before the National Assembly aims to gradually raise VAT on luxury goods, while essential items consumed by poorer and vulnerable Nigerians would remain exempt from VAT or attract a zero rate. “In terms of VAT, President Bola Tinubu’s commitment is that while implementing difficult and wide-ranging but necessary reforms, the poorest and most vulnerable will be protected,” Edun said. “So, the Bills going through the National Assembly in terms of VAT will raise VAT for the wealthy on luxury goods, while at the same time exempting or applying a zero rate to essentials that the poor and average citizens purchase.” He added that the list of essential goods exempted from VAT will be made available to the public in due course. In September, Chairman, Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, said the committee was proposing a law to the National Assembly to increase value-added tax from the current 7.5% to 10%. He had said, “We have significant issues in our tax revenue. We have issues of revenue generally which means tax and non-tax. You can describe the whole fiscal system in a state that is in crisis ALSO READ:Yahaya Bello: Court Fixes Date For Response To Summons In Alleged Fraud Suit “When my committee was set up, we had three broad mandates. The first one was to look at governance: our finances as a country, borrowing, coordination within the federal government and across sub-national. “The second one was revenue transformation. The revenue profile of the country is abysmally low. If you dedicate our whole revenue to fixing roads it will be insufficient. The third is on government assets. “The law we are proposing to the National Assembly has the rate of 7.5% moving to 10% from 2025. We don’t know how soon they will be able to pass the law. Then subsequent increases are also indicated in terms of the year they will kick in.”