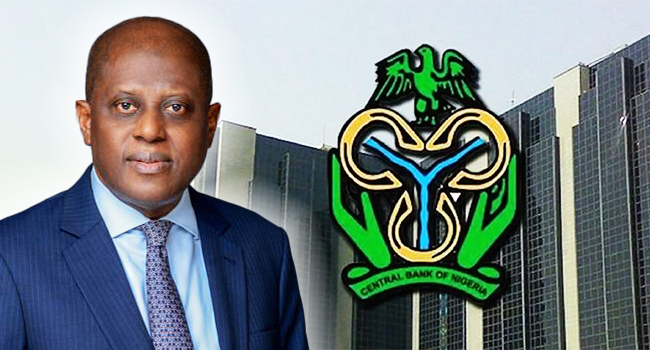

As the nation awaits the final recommendation of the tripartite committee on the new national wage for workers, the Central Bank of Nigeria (CBN) has been advised to be wary of the necessary monetary policy measures to take against possible adverse consequences.

Specifically, the analysts, including Paul Alaje senior economist, SPM Professionals, John Agbo, chartered stockbroker and Friday Ameh, energy consultant, among others advise CBN to ensure that other economic variables, like accretion to the nation’s buffers, inflation as well as exchange rate must have to be tackled effectively.

They further argue that monetary policy measures must be in sync with the fiscal policies, adding that issues of insecurity, infrastructure must be given adequate attention.

Alaje, who spoke on the Channels Television’s Money Brief, program said any minimum wage below N100,000 should be seen as celebrating poverty, adding that between N100,000 and N150,000 should be reasonable.

The economist agreed that the new wage will stoke inflation, warning that, the hawkish stance of CBN may likely result in contraction of the economy. According to him, continued increase in the monetary policy rate as the only antidote to inflation is counter productive,as the rise in money supply could result in contraction adding that three consecutive contractions result in recession.

ALSO READ:Concerns Over Continued Exchange Rate Volatility Amid Crude Oil-Backed Loan Agreement

With rising interest rate, he added, economic activity will be reduced as companies will continue to produce below capacity utilization, banks will not give out loans that would energize the economy,stressing that the wage increase will rather be spent on consumption than production. He said only productive activities can bring about growth and development.

Agbo was of the opinion that more investments are needed in infrastructure to reduce cost of production, reduce post harvest losses occasioned by lack of good roads and stable power.