ABIDJAN, Côte d’Ivoire, 24 January, 2024 -/African Media Agency(AMA)/-The African Development Bank, rated Aaa/AAA/AAA/AAA (Moody’s/S&P/Fitch/Japan Credit Rating, all stable), has launched and priced a USD 2 billion 3-year Social Global Benchmark due 25 February 2027, its first social bond issued under its new Sustainable Bond Framework, established in September 2023. The Sustainable Bond Program seamlessly consolidates and enhances the African Development Bank’s existing Green and Social Bond programs, facilitating the issuance of green bonds, social bonds, and sustainability bonds.

This new 3-year Social Benchmark is the Bank’s first global benchmark of the year, strategically aligning with the robust reopening of primary markets in January 2024. This issuance is a significant highlight amid a dynamic week in the USD SSA markets, witnessing the launch of 8 benchmarks totaling USD 17.25 billion within a span of two days.

With this transaction, the African Development Bank continues to carry out its funding strategy of issuing large liquid benchmark transactions and adds another on-the-run reference in the 3-year maturity. The Bank was able to successfully secure the tightest pricing among Multilateral Development Banks (MDBs) both versus swaps and US Treasuries.

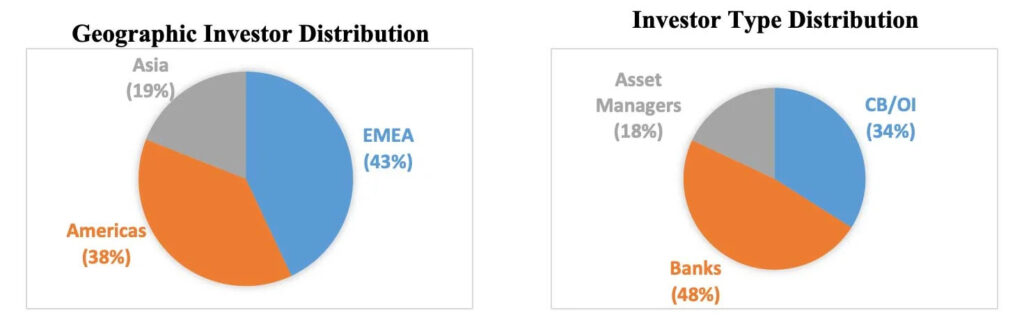

The issuance received strong support from the global investor community, with an order book in excess of USD 3.5 billion and attracted high-quality investors, including central banks, official institutions, and bank treasuries, constituting 78% of the book. Distribution was well diversified across geographies and investor profiles, with 76 orders in the book. The social label garnered interest from ESG investors, representing 38% of participants in the book.

The AfDB’s mandate for a 3-year USD Global Benchmark was announced on Wednesday 17 January at 15:00 London time, taking advantage of favorable market conditions and a strong primary market backdrop. Initial Pricing Thoughts (IPTs) were released at SOFR mid-swaps plus 33bp (basis points) area. The deal enjoyed good investor demand during the overnight session with Indications of Interest (IoIs) reaching USD 2.1 billion by the time books officially opened on Thursday 18 January at 08:00 London time.

The orderbook continued to grow throughout the European morning, with investor demand reaching USD 3.6 billion by 10:50 London time, which allowed the spread to be tightened by 2bps and set at SOFR mid-swaps plus 31bps. Books closed at 13:00 London time, and the high quality of the orderbook, which was in excess of USD 3.5 billion, allowed for the launch of the transaction with a size of USD 2 billion. The trade officially priced at 15:18 London time with a reoffer yield of 4.221%, equivalent to a spread of 10.3bps vs UST 4% Jan-27, the tightest print vs UST in the USD SSA primary market so far this year.

The final orderbook closed in excess of USD 3.5 billion with more than 70 orders.

Distributed by African Media Agency (AMA) on behalf African Development Bank.

The post African Development Bank launches a new USD 2 billion 4.125% 3-year Social Global Benchmark due 25 February 2027 appeared first on African Media Agency.