Nigerian deposit banks are expected to submit action plans indicating their level of commitment to meeting the new capital base requirement as deadline ends today.

Metrobisinessmews.com (MBN) gathered that most of the banks were favourably disposed to ‘rights issue’ so as to maintain the current ownership structure and possibly enhance it.

Of particular interest is the current arrangement that breeds, majority shareholders/owners as chairmen of the Holden Companies, particularly among the tier one lenders.

The Central Bank of Nigeria (CBN) had, last month, raised the capital requirement of banks in the country, giving them a two year period to meet the new capital base or explore other options such as mergers/acquisitions or downgrade of banking license.

According to the new requirement, commercial banks with international licenses are required to have a capital base of N500 billion while their national and regional counterparts are required to have capital base of N200 billion and N50 billion respectively.

Similarly, the capital base of national non-interest banks were raised to N20 billion while that of regional non-interest was raised to N10 billion. Merchant banks capital base was also raised to N50 billion.

Consequently, Access Holdings Plc, the parent body of Access Bank, is the first to get shareholders approval to raise additional capital at the end of its second Annual General Meeting(AGM) in Lagos at the weekend.

Shareholders of the financial conglomerate had approved the N365 billion rights issue out of the $1.5 billion for capital raising alongside the N1.80 kobo dividend payment, which made it a total of N2.80 paid for 2023.

Although FBN Holdings, the parent body of First Bank of Nigeria, had scheduled an Extraordinary General Meeting for the end of this month to raise additional N300 billion to shore up its capital base, the EGM was suddenly cancelled following the sudden resignation of rhe managing director.

Also, Zenith Bank has its EGM last week where shareholders approved the Holding Company structure.

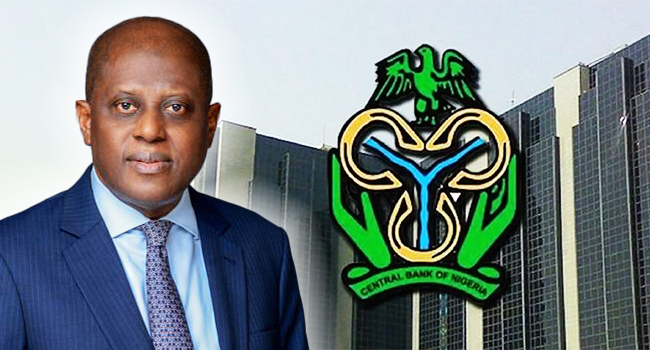

The CBN governor, Dr Olayemi Cardoso, at the 2024 Spring Meetings of the International Monetary Fund (IMF)/ World Bank mentioned that the banks have ample time to come up with strategies to raise the needed capital.

Cardoso, while speaking during the ‘Governor Talks’ said, he had, at the Bankers’ Dinner held last year, communicated the intentions of the apex bank concerning the plan to raise capital base in the banking industry.

“I used that opportunity to communicate very strongly on forward guidance with respect to the banking sector, and to let people know that we were going to have a recapitalisation exercise. This was in November and the guidelines didn’t come out till just recently. So, we had plenty of time to start thinking that through,” he said.

To meet up with the new capital base, the Nigerian banking industry may be seeking to attract over N3 trillion. Options of raising capital includes; mergers and acquisitions as well as reclassification which means either an upgrade or downgrade of banking license had been placed before the banks.

With almost all the banks faced with a shortfall in capital, sources in the banking industry say, the top five banks in the country may be the only ones that may be able to attract foreign investors and raise the N500 billion capital.

Head of Financial Institutions at Agusto & Co, Ayokunle Olubunmi, said, for many banks, asides the top five, their options would be to merge or reclassify their licenses. According to him, the first thing that most of them will consider is if they want to raise capital or they want to partner with somebody.

“For those that have a significant amount of money to raise, they will be thinking of probably going ahead to raise the fund or look for another bank that also have that challenge, they come together and have a formidable entity.

ALSO READ:President Tinubu Launches Consumer Credit Scheme Across Nigeria

“Another challenge that a lot of banks will face will be getting the right partners particularly those that want to go the route of mergers, because if they merge with a bank that they don’t share the same vision, the institution will fail from day one. After the last consolidation, there were some that from day one the board was always fighting.”

He noted further that, although the situation is improving, attracting foreign investors might be a challenge for some of the banks, adding that, the banks cannot afford to have foreign portfolio investors, rather, they will have to seek out “institutional investors who will be here for the long haul. Investments in Nigeria is not for the short term, particularly for banks. they need to understand the terrain. And it is not everyone that understands Nigeria’s environment. So, that might be a challenge.”

For the merchant banks, he said, “there are some banks that the investors will say it is not worth it. Like the merchant banks which have not been profitable and they have very low capital base. It is also the same for banks that are not that profitable it will be a challenge because the current investors will not want to invest more in something that is not that profitable and if they are going to get foreign investors they might not be able to get good valuation on the banks.”

CBN is expected to commence soon scrutinization of the plans of action by the various banks, investigating and possibly getting in touch with them for further clarification, a source said.