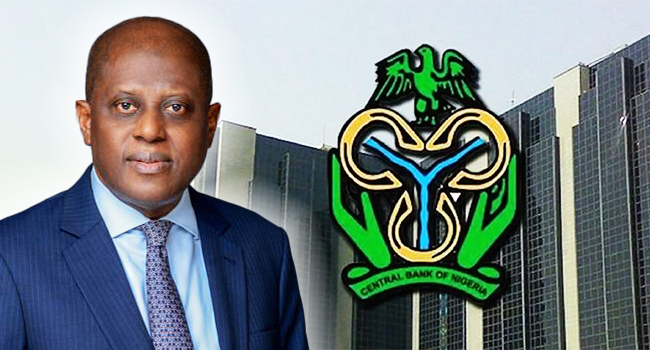

The Central Bank of Nigeria (CBN) is set to return to full orthodox banking in its desire to bring about expected Price and exchange rate stability so as to promote sustainable economic growth and development, says, Yemi Cardoso its governor at the post 2-day MPC meeting press briefing in Abuja on Tuesday.

Consequently, amid slowing Inflation, the CBN’s Monetary Policy Committee increased its benchmark interest rate, known as the Monetary Policy Rate (MPR) by 50 basis points to 27.25 percent, the fifth straight hike this year.

It also raised the Cash Reserve Ratio for commercial banks by 500 basis point to 50 percent from 45 percent, a development that will see half of banks’ cash in their vaults, supposedly for lending to the real sector and small and mediun scale enterprises (SMSEs), being idle and sterilized with CBN

Cardoso said all the members agreed to hold other parameters unchanged.

In Orthodox banking, the CBN is expected to be more committed to traditional banking practices that adhere to established principles and norms, often emphasizing caution and stability over innovative or unconventional approaches.

The implication is that Cardoso’s CBN is likely going to shift focus away from unorthodox or unconventional monetary policies, such as quantitative easing or negative interest rates.

With emphasis on caution and stability, CBN will now resort to traditional monetary policy tools, such as interest rates, reserve requirements, and open market operations to achieve its mandate of maintaining economic stability and minimizing risk.

In a response to specific achievements of his tenure in the last one year Cardoso said this can be more appreciated when one considers the situation of things when they took over last November .

The Governor had last year given his monetary policy outlook for 2024, focusing on price and exchange rate stability, and also adopting Inflation targeting framework to bring it to 24 percent.

However, their achievements have rather been achieved in breach as naira has lost over 70 percent of its value in the last one year.

The unification of rates and subsidy removal have brought untold hardships on the citizens with inflation at over 30 percent and food inflation at a time over 40 percent.

Against this backdrop and uncontrolled and massive liquidity in the system then, according to Cardoso,they have been able to bring back confidence and build trust in the system.

The Governor has expressed optimism about the exchange rate performance, anticipating a decline in inflation and exchange rate pressures in 2024.

He also said they have been able to embark on proactive and transparent action like suspension of some banks from the foreign exchange market due to some infractions, suspension of charges on cash deposits above N500,000, which he said reflect the institution’s commitment to mitigating economic challenges and fostering stability.

“We have been able to restore confidence and building back the trust… We are not there yet, but a lot of progress has been made. The payment of backlog was part of the building trust process… We are returning back to full orthodox banking and hence looking at things dispassionately and this is important to face orthodox mandate. We are trying to get out of unorthodox Central baking so as to ensure price discovery in the fx market… Rating agencies have given us positive ratings and it speak volumes as they are not giving to emotions. We are aware and conscious of the fact that many are finding things difficult outside,because we are not there yet but these are short term pains which wil soon fizzle out. We have brought about transparency in our operations, particularly in fx market…” Cardoso said.

Analysts Speak;

Most analysts had expected the CBN to pause rate hike following the slowing inflationary pressures and increase in foreign inflows.

However, some of them said with the adoption of the Orthodox banking, CBN might continue to hike even when the inflation is coming down

“The principle of orthodox banking does not give higher level of flexibility as unorthodox policies in responding to exceptional economic circumstances and that would mean CBN continuing with hike until they are convinced that it’s safe to pause. There’s no innovation and as such actions, most times, are unidirectional,” says Friday Ameh, Lagos based analyst

ALSO READ:Direct Lifting Of Petrol From Dangote Will Crash Prices, Oil Marketers Assure Nigerians

According to Joseph Nnanna,chief economist, Development Bank of Nigeria (DBN), although the hike was not expected and even then the magnitude was much, it will make banks to reprice facilities given out and this will be felt across all the sectors.

The implication, according to Nnanna, who spoke on Channels Television, will be, higher lending with its negative impact on the economy.

However, with the expressed determination of CBN towards Price stability and fighting inflation, Nnanna says there’s need for synergy with the fiscal authorities.

Olatunde Amolegbe managing director, Arthur Steven Asset mgt, says the CRR hike reduces liquidity for borrowing and possibly speculations in the fx market.

Banks would increase lending rate and this will increase pressures and particularly on NPL, Amolegbe, who spoke on Channels Television in reaction to the CBN’s policy said.

Structural imbalances, he said, would lead to higher inflation again, until and unless the insecurity and other challenges are tackled .