*Hope Rises On Economy

The United States Federal Reserve on Wednesday slashed interest rates by a half percentage point, charting a course for two additional cuts this year and followed by four more in 2025.

With dissenting voices, the committee believes that risks to meeting both inflation and employment objectives are now more balanced to warrant easing.

Analysts say last night that the U.S. Fed’s rate cut is likely to influence the decision of Nigeria’s Monetary Policy Committee (MPC), which meets next week to discuss potential rate adjustments.

Their reasoning is that the rate cut will eventually attract funds from foreign investors, chasing higher interests, a development that could accelerate the execution of the Central Bank of Nigeria (CBN)’s mandate, particularly with price and enhance rate stability, with the possibility of changing the current negative sentiments against CBN.

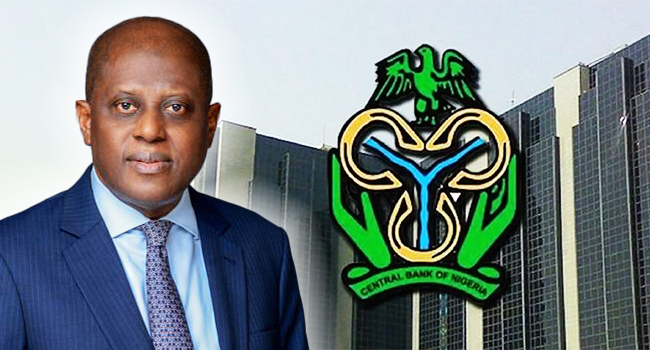

The Fed’s move could in the main time ‘stabilize’ Cardoso’s position as it may provide him and his team ‘warchest’ to execute, possibly with results, the apex bank’s mandate by bringing sanity into the foreign exchange market and the embattled naira.

This is because the new policy will attract foreign portfolio investments (FPIs) back into Nigeria for more accretion to the external reserves and relieve for the exchange rate.

Consequently , the inflow of foreign capital could boost Nigeria’s financial markets and strengthen its economy.

The action of Fed marks its first easing of monetary policy since 2020 and the termination of its most aggressive inflation-fighting campaign since the 1980s

The decision came in a split vote at the conclusion of the Fed’s two-day policy meeting as officials cut the central bank’s benchmark rate by 50 basis points to a new range of 4.75%-5.0%.

Rates had previously been held at a 23-year high since July 2023.

But the outlook for interest rate projections comes as Fed officials now see the unemployment rate ticking up to 4.4% from its previous forecast of 4.0%.

Inflation is seen ending the year at 2.6% and the economy is seen growing at 2% instead of 2.1% for this year and holding that 2% level the next two years.

However, there was some divisions on the final decision, with Fed governor Michelle Bowman dissenting. She preferred to cut rates by 25 basis points instead of 50.

No Fed official has voted against a policy decision in two years, matching one of the longest such streaks in the past half century. Moreover, no Fed governor has dissented on a rate decision since 2005.

The consensus among Fed officials at Wednesday’s meeting was that they now see two more 25 basis point cuts this year, followed by four more cuts next year and two more cuts in 2026.

Nine officials saw 4 cuts this year, seven saw three cuts, 2 officials saw two cuts this year and one saw 5 cuts this year.

When considering additional rate cuts, the Fed said it will assess incoming data, the evolving outlook and the balance of risks.

Officials made their decision today because they are increasingly concerned about a slowing labor market and have gained confidence inflation is likely heading back down to their 2% target.

Employment decelerated over the summer with 118,000 jobs created in June, 89,000 created in July and 142,000 in August — all below the average monthly gain of 202,000 over the prior 12 months.

Some Fed officials thought a cut could have been made at the central bank’s last meeting in July, according to minutes from that meeting.

ALSO READ:Yahaya Bello Wanted, Not In Our Custody –EFCC

Fed Chair Jay Powell said in his last speech in Jackson Hole, Wyo., in late August that the Fed “will do everything we can to support a strong labor market as we make further progress toward price stability.”

He noted that the Fed does not “seek or welcome further cooling in labor market conditions” and that the current level of the policy rate gives the Fed “ample room” to lower rates in response to any weakening in the job market.

Another big reason for the cut is the increasing confidence Fed officials have about the direction of inflation. That confidence was reinforced by five consecutive reports from the Consumer Price Index that showed progress after some hotter-than-expected readings in the first quarter.

Officials said in their statement that inflation has made “further progress” instead of “some further progress” towards the Fed’s 2% goal, but still remains somewhat elevated.

“The Committee has gained greater confidence that inflation is moving sustainably toward 2% and judges that the risks to achieving its employment and inflation goals are roughly in balance,” the policy statement read.

Some analysts say last night that the current development might influence the likely outcome of the MPC meeting, with the possibility of cutting or maintaining the rate as it strives to balance inflation concerns with the need to stimulate economic growth.

They were quick to add, however, that there are consequences of stimulation of both private and public sector spending and economic growth with the possibility of cheaper imports.

This is because, imported inflation has been a source of worry for our economic managers and as foreign goods become more affordable, Nigerian businesses might face increased pressure from imports, impacting their profitability and market share