Faced with dwindling fortunes ocassioned by rising debt servicing, foreign obligations and savings the value of the local currency, the Central Bank of Nigeria (CBN) has requested all deposit money banks and other financial institutions to send to it, all dormant accounts, unclaimed balances, and other financial assets.

According to the CBN, through a circular signed by Acting Director of the Financial Policy and Banking Regulation Department, John Onojah, dated July 19, 2024, all dormant accounts and unclaimed balances with banks for at least 10 years will be warehoused in a dedicated account known as the Unclaimed Balances Trust Fund Pool Account.

Metrobusinessnews.com checks reveal that the action is in line with the current aggressive moves by the federal government to buorge its finances to meet existing and new demands.

Besides, with the rising debt servicing as well as falling revenue to GDP, the federal government is becoming uncomfortable.

Further investigations reveal that the new policy would unearth many sharp practices by some banks, whose some of its staff have been ‘feeding’ on dormant accounts, particularly, whose owners are dead.

Sources at the apex bank told MBN that the policy would provide opportunity to CBN to compare with its quarterly and half yearly as well as off-site and on-site inspections with those that have been declared by the lenders in their annual accounts.

Already, it was further gathered that CBN has been investigating some banks involved in this unwholesome practices as well as verifying the processes of meeting the new capital requirements as submitted by them

This is even as they are high level discussions going on among some banks to pool resources together so as to meet the new capital requirements.

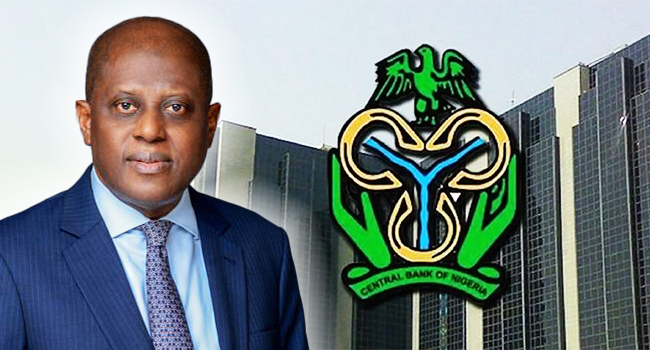

However, Yemi Cardoso, CBN governor had recently said that accretion to the nation’s foreign reserves in the next few months would reduce as government honours its foreign obligations, among other commitments.

Already CBN has resumed sales of foreign exchange to Bureau De Change as the value of the naira continues to nosedive, widening the gap between the official and black market rates.

In the circular, CBN added that the funds from dormant accounts, unclaimed balances may be invested in Nigerian Treasury Bills and other government securities.

The CBN, however, said the new guidelines which is a review of the guidelines issued in October 2015, exempted dormant accounts, and unclaimed balances under litigation and investigation.

The guideline reads, “CBN shall treat unclaimed balances (dormant accounts and financial assets) as follows:

“Open and maintain the ‘UBTF Pool Account’, maintain records of the beneficiaries of the unclaimed balances warehoused in the UBTF Pool Account.

“Invest the funds in Nigerian treasury bills (NTBs) and other securities as may be approved by the ‘Unclaimed Balances Management Committee.

“Refund the principal and interest (if any) on the invested funds to the beneficiaries not later than 10 working days from the date of receipt of the request and where it is imperative to extend the timeline, a notice of extension shall be communicated to the requesting FI stating reasons for the extension.”

REUNITING FUNDS FOR BENEFICIAL OWNERS

In the document, CBN said the objectives of the guidelines are to “identify dormant accounts/unclaimed balances and financial assets with a view to reuniting them with their beneficial owners”.

“Hold the funds in trust for the beneficial owners; Standardize the management of dormant accounts/unclaimed balances and financial assets,” the apex bank said.

“Establish a standard procedure for reclaim of warehoused.”

10 YEARS DORMANCY

According to the financial regulator, eligible accounts are dormant account balances that have remained with the institution for 10 years and beyond.

“Eligible dormant accounts/unclaimed balances and other financial assets shall include: Current, Savings and term deposits in local currency,” CBN added.

“Domiciliary accounts; deposits towards the purchase of shares and mutual investments; Prepaid card accounts and wallets; Government owned accounts;

“Proceeds of uncleared and unpresented financial instruments belonging to customers or non-customers of FIs.”

Furthermore, the CBN said it will open and maintain an account earmarked for the purpose of warehousing unclaimed balances in eligible accounts.

The account shall be called the ‘Unclaimed Balances Trust Fund (UBTF) Pool Account’.

In addition, the CBN shall establish a management committee to oversee the operation of the UBTF pool account, monitor and enforce compliance with these guidelines; and manage the funds in line with the provisions of BOFIA 2020;

Other stakeholders of the unclaimed accounts are the Nigeria Deposit Insurance Corporation (NDIC) and financial institutions.

REACTIVATION, UNCLAIMED FUNDS

To reactivate a dormant account, CBN said the account owner or beneficial owner must complete a reactivation form in person.

“Obtain from the account owner evidence of ownership of the dormant account with valid means of identification, evidence of present place of residence, and affidavit on the accuracy of the information to reactivate the dormant account,” the apex bank said.

ALSO READ;FG’s Resolution Of National Minimum Wage Crisis, Great Relief For Nigerians- Group

“Verify the information provided on the reactivation form; Not charge any fee for reactivation of dormant account.

“Reactivate the dormant account with the approval of two (2) authorized officers with one being at least the branch operations manager.

“Reactivate dormant accounts within a maximum of three (3) working days of receipt of a written application to that effect.

“Notify the account owner, free of charge, upon reactivation of the account.”

Also, to access the list of unclaimed balances transferred to CBN on the websites, the account owner/beneficial owner shall provide evidence of account ownership, valid means of identification, evidence of the present place of residence, and an affidavit on the accuracy of the information to reactivate the account.

“The profit and loss ratio on the unclaimed balances for non-interest banks shall be determined by the CBN from time to time;

“The FIs shall verify the claim and initiate the request with supporting documents to CBN within ten (10) working days;

“Application for reclaim shall be to the director banking services department, CBN;

“CBN shall refund unclaimed balance to the account owners/beneficial owners through their FIs within ten (10) working days from the date of the receipt of the FI’s request.

“Beneficial owners shall not make partial claims; and the right of beneficial owners to reclaim shall be indefinite.”

CBN said monitoring and enforcement of banks and financial institutions will be through off-site surveillance as well as on-site routine and target examinations.