The revocation of the operating licence of Heritage bank on Monday has continued to provoke discussions on the safety or otherwise if the industry, regarded as the engineroom of the economy.

Specifically, some analysts say the action by CBN, though commendable, is at variance with the assurances by the regulator in recent times.

More worrisome is the ‘endless’ period for paying liquidation dividend by the Nigeria Deposit Insurance Corporation (NDIC), a development that has continued to be nightmares to few surviving customers, who are fortunate ro be alive for the dividends,some decades after liquidation of the banks.

The official response from House of Representatives, According to some analysts, does not show that the required oversight functions were being carried out as expected of the legislature.

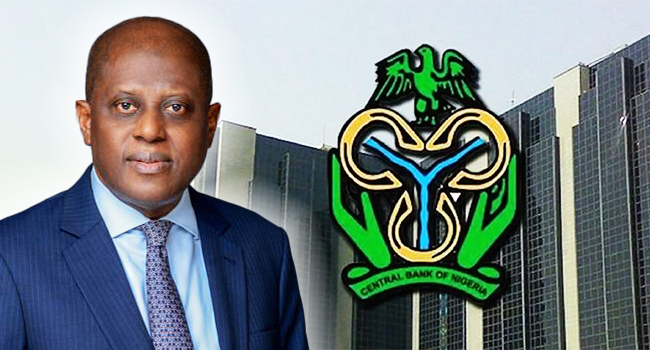

At the post Monetary Policy Committee meeting press briefing On May 21, 2024, CBN governor, Yemi Cardoso said, ”The Committee noted with satisfaction that the banking system remains safe, sound, and stable, despite the headwinds confronting the economy. It commended the recent recapitalization initiative and urged the management to sustain its regulatory oversight to ensure the continued stability of the banking

system.”

However, justifying the liquidation of the bank on Monday, June 3, CBN said the bank’s Board and Management did not improve the bank’s financial performance, a situation which constitutes a threat to financial stability.

”This action has become necessary due to the bank’s breach of Section 12 (1) of BOFIA, 2020. The Board and Management of the bank have not been able to improve the bank’s financial performance, a situation which constitutes a threat to financial stability. This follows a period during which the CBN engaged with the bank and prescribed various supervisory steps intended to stem the decline. Regrettably, the bank has continued to suffer and has no reasonable prospects of recovery, thereby making the revocation of the license the next necessary step.

Consequently, the CBN has taken this action to strengthen public confidence in the banking system and ensure that the soundness of our financial system is not impaired.”

Reaction to the bank’s liquidation, few hours after the announcement, the House of Representatives, through its Spokesman / Chairman, House Committee on Media & Public Affairs, Akin Rotimi, assured the public of its commitment to carrying out its constitutional oversight functions to ensure that the development does not negatively impact Nigerians.

ALSO READ:CBN Revokes Licence Of Heritage Bank

“We assure the public, particularly depositors and stakeholders of Heritage Bank, that the House is committed to carrying out its constitutional oversight functions to ensure that this development does not negatively impact Nigerians. The relevant House Committees on Banking Regulations; and Insurance will be up to their duty, thoroughly examining the circumstances surrounding this decision and the subsequent steps taken by the NDIC.

“Our priority is to safeguard the interests of all depositors and maintain the stability of the financial system. We will engage with the CBN, NDIC, and other relevant stakeholders to ensure a transparent and orderly resolution process, providing necessary support to mitigate any potential negative impact on the public.

“Furthermore, we urge the CBN and NDIC to establish clear channels of communication to allay the fears of the public and prevent any loss of trust in our financial system. Effective public engagement is crucial to maintaining confidence during this period.

“Chairman of the House Committee on Banking Regulations, Rep. Mohammed Bello El-Rufai, stated,

“The Committee on Banking Regulations will closely monitor the liquidation process to ensure that the rights of depositors are protected and that the process adheres to the highest standards of transparency and accountability.”

“Similarly, the Chairman of the House Committee on Insurance and Auctuarial Matters, Rep. Ahmed Usman Jaha, emphasised, “We will work diligently to oversee that the NDIC executes its mandate effectively, ensuring the protection of depositors’ funds and maintaining confidence in the financial sector. The NDIC Act and the Banks and Other Financial Institutions Act (BOFIA) are clear in their provisions that depositors’ funds are insured and protected.”

“We urge all depositors and stakeholders to remain calm and be assured of our dedication to protecting their interests.”