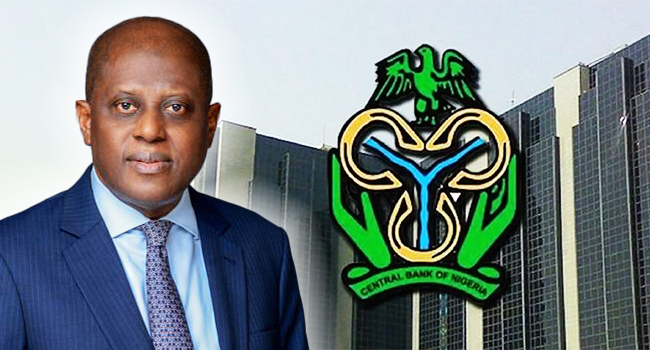

For the Central Bank of Nigeria (CBN) governor, Yemi Cardoso, the Monetary policy Committee is committed to price stability using available tools, while urging the fiscal authorities to complement their efforts by tackling insecurity and decayed infrastructure

Claiming that the hikes have continued to have positive impact on the economy with decelerating inflationary pressures, Cardoso said the MPC has increased the benchmark interest rate by 150 basis points to 26.25% from 24.75%.

But analysts and manufacturers insist that the hike would further hurt the economy even as their warehouses are full of unsold stocks.

According to them, there is a limit to which they can pass on the consequential rise in prices of goods to final.consumers, adding that consumer resistance has set in that will upset the system.

Biodum Adedipe, chief consultant at Biodum Adedipe and Co says hikes of 750 basis points within a short time is huge and the resulting high cost of funds would impact negatively on the real.sector.

Adedipe says the small entrepreneurs and householders that borrow from the Microfinance banks would suffer more.

The banks, he added, would embark on upward review of the facilities and at the end of the day, might lead to rise in loan defaults as well as reduction in creating loans by banks, which night not make the envisaged rise in GDP possible. The analysts spoke on Channels Television Business Incorporated program.

Also Joseph Nnanna, chief economist at Development Bank of Nigeria (DBN), who also featured on Channels Television program, Business Incorporated says the hike would impact negatively on those at the bottom of the pyramid, as well as the MSMEs.

Nanna sees the hike as a signal to the fiscal authorities to Play their own part through discipline, prioritize spendings among others.

He was however positive that the hike would bring in some investors who would like to take advantage of the rates

However, the MPC retained the Cash Reserve Ratio (CRR) of Deposit Money Banks (DMBs) at 45% and put the Asymmetric corridor around the MPR at +100 and –300 basis points. The bank further set the liquidity ratio of banks at 30%.

Yemi attributed the third consecutive hike in bank interest rates in 2024 to continued efforts towards moderating inflation which reached 33.69% in April 2024 according to the National Bureau of Statistics (NBS).

ALSO READ:Nigeria’s April Inflation Rate Increases To 33.69%, May Trigger Marginal Rate Hike By MPC

Also, he noted that members of the MPC the significant decline in other inflation such as food and core inflation suggest the positive effects of the apex bank’s hawkish monetary policy stance since the beginning of the year.

According to Cardoso, “The committees’ decisions are as follows; raise the MPR by 150 basis points to 26.25% from 24.75%. Retain the asymmetric corridor around the MPR to +100 to –300 basis points. Retain the Cash Reserve Ratio (CRR) of Deposit Money Banks (DMBs) at 45% and retain the liquidity ratio at 30%.”

“The key focus of the MPC at this meeting remained to achieve price stability by effectively using tools available to the monetary authority to rein in inflation. Members observed that while year-on-year headline inflation in April 2024 rose moderately, the month-on-month headline food and core inflation declined significantly”