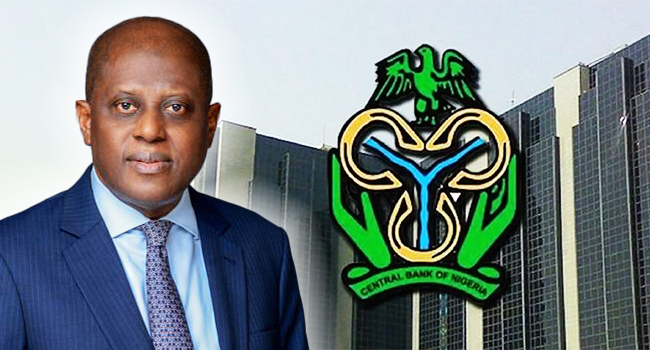

Amid rising insecurity, declining value of the local currency, climate change and oil theft, among others, analysts have expressed cautious optimism on the recipe for drop in inflation in 2024 by Yemi Cardoso, Central Bank of Nigeria (CBN) governor.

Cardoso had said that Nigeria’s inflation rate will drop from 28.92 per cent to 21.4 per cent in 2024.

The governor, who made the projection on Tuesday in Abuja, when he addressed the House of Representatives, based the projected decline in the country’s inflationary pressure to inflation-targeting policies of the Federal Government.

He said that improvement in agricultural productivity and easing global supply chain pressures would also contribute to reining in inflation.

“Inflationary pressures are expected to decline in 2024 due to the CBN’s inflation-targeting policy, aiming to rein in inflation to 21.4 per cent.

“This will be aided by improved agricultural productivity and easing global supply chain pressures.

“The CBN’s inflation-targeting framework involves clear communication and collaboration with fiscal authorities to achieve price stability, potentially leading to lowered policy rates, stimulating investment, and creating job opportunities,” he said.

But most analysts that spoke with metrobusinessnews.com (MBN) expressed cautious Optimism giving the fact that the rising insecurity particularly in the northern and central regions of the country has virtually stopped farmers from going to their farms.

Adamu Abdullahi, from Zamfara state would rather prefer a declaration of state of emergency on food security, identifying rising insecurity, corruption as part of the factors militating against food security in the country.

Abdullahi, who spoke on Arise Television’s, The Morning Show, program on Wednesday and monitored by MBN said a situation where farmers pay taxes to bandits before accessing their farms and also before harvesting in his home state, means that all is not well with the country.

Another analyst said the optimism of the governor is utopian and hypothetical since inflation targeting as a deliberate policy does not guarantee food sufficiency.

Besides, he regarded the projected which he said was without backing with how to achieve it as ‘wishful thinking and another rhetoric.’

His word: “This is not the time for rhetorics as Nigerians are tired of government officials coming on stage to give empty promises. Past Governors of CBN, at least some of them, had adopted inflation targeting as a deliberate policy and what came out of it? The Iimmediate past Governor christened his own policy as developmental central banking, with billions of naira gone into intervention programs. What did we achieve as a country rather that the monies going down the drain. He (Cardoso) should have told the country what and how he intends to do differently’ he said.

Another analyst also faulted his postulation that his optimism will be aided by improved agricultural productivity and easing global supply chain pressure.

According to him, it amounts to ‘turning the truth upside down’ to expect improved global food chain in the midst of raging Russian-Ukraine war that has rather disrupted food chain and transportation of food, particularly wheat and the devastating effect of the war in Gaza that is even impacting negatively on the prices of pertroleum products, major sources of the country’s foreign earnings.

“So, how will the combination of all these bring about improved global food chain, with current prices of 50 kg bag of local rice going for over N60, 000 and foreign one, N70, 000?”

The Governor also told his audience that the Nigerian foreign exchange market was currently facing increased demand pressures, causing a continuous decline in the value of the Naira.

According to him, factors contributing to this situation include speculative forex demand, inadequate forex supply due to non-remittance of crude oil earnings to the CBN, increased capital outflows, and excess liquidity from fiscal activities.

“The shift to a market-driven exchange rate is intended to create a stable macroeconomic environment and discourage currency hoarding.

“However, short-term volatilities are attributed to arbitrage and speculation.

“To address exchange rate volatility, a comprehensive strategy has been initiated to enhance liquidity in the FX markets.

“This includes unifying FX market segments, clearing outstanding FX obligations, introducing new operational mechanisms for Bureaux De Change (BDCs), enforcing the Net Open Position (NOP) limit, and adjusting the remunerable Standing Deposit Facility cap,” Cardoso said.

He said the steps taken were having huge economic cost impact on the citizenry.

“These costs are temporary, and our decisions will address a lot of fundamental issues bothering Nigeria’s macroeconomic landscape.

“These measures, aimed at ensuring a more market-oriented mechanism for exchange rate determination, will boost foreign exchange inflows, stabilise the exchange rate, and minimise its pass-through to domestic inflation,” he said.

However, Bismarck Rewane, chief executive officer of the Financial Derivatives Company would not agree that naira is jinxed.

Rewane, who appeared on Channels Television’s Politics Today program to give more insight into his February 6, report said:

“The naira is undergoing a shift to its true value after almost a decade of forex market imbalance, a cut-throat market structure, uncertain exchange rate expectations, and capital control measures.

The naira’s decline is fueled by rising inflation and a cost-of-living crisis. Key commodity prices have more than doubled since May 2023, contributing to a 27-year high in headline inflation at 28.9%. Additionally, the naira has lost 17% of its value in 2024, following a 39% loss in 2023, with the official rate hitting a record low of N1450/$, compared to N490/$ in 2016.”

He attributed reasons to naira’s depreciation to, “dollar scarcity, fear, lack of confidence in the naira, speculation, negative real rates of return, restrictions, and exchange controls. The root causes are both structural and transient. Crude oil, a major contributor to Nigeria’s exports, has seen output declines due to theft and vandalism, impacting potential dollar earnings. Loss of confidence in the naira further fuels speculation, arbitrage, and hoarding of dollars, causing market disruptions.”

His listed antidote to naira’s issues to include, “rebuilding confidence in the FX markets is the first step. To attract investors, interest rates need to match inflation and narrow negative real rates of return. A minimum 200bps hike is projected at the next MPC meeting on February 26/27. Additionally, the CBN should implement an open auction system, dismantling the monopolistic FX market structure to let demand and supply determine prices.”