* Banks Struggle For In-House Cleansing

*Panel May Beam Searchlight On Concluded M&A Exercises, Ownership Structure, Financials Of Banks

*Operators Put Ongoing Acquisition Discussions On Hold

* Bank CEOs On Red Alert

John Danjuma Omachonu

With the possibility of taking over ownership of Nigeria’s iconic brand, 104-year-old Union bank (UBN) Plc and one of the newest brands, Titan Trust Bank (TTB) which started operations in 2019, by the federal government, following alleged damning revelations on the acquisition of the later by the former and the invitation of one of the most respected former deputy governors of the Central Bank of Nigeria, (CBN) and chairman of TTB, Babatunde Lemo alongside two other purported shareholders of the bank by the Special Investigation Panel on CBN to Abuja on Thursday, Nigerians are gradually coming to terms with the reality that it’s no longer business as usual in the industry.

Indeed, the alleged inability of Lemo and the two other prominent shareholders and largest ultimate investors in both banks (Mr. Cornelius Vink; Mr. Rahul Savara) to Honour the invitation may further worsen the frosty relationship between the panel and the owners, a development, some analysts say, may hasten the process of the take over by the federal government.

Already the Jim Obazee panel has made it clear, in response to the letter from their Lawyers, G-Elias, that the trio are not in the country to honour the invitation, that the action is an affront on the panel and would resort to necessary sanctions for non appearance.

Specifically, the office of the Special Investigator, in a letter dated December 27,and signed by DCP Eloho Okpoziakpo, threatened to invoke relevant sections of its earlier letter of invite that listed the consequences such as forfeiture of shares in the banks for their failure to honour the invite.

Specifically, the December 24 letter referenced CR:3000/TSI/ABJ/Vol.1/69 warned that they would forfeit their shares in the two banks if they failed to honour the December 28th invitation and provide/defend the documents requested.

“Kindly note that if Messrs. Cornelius Vink and Rahul Savara refuse to attend this meeting and provide/defend the requested documents/information, it will be construed that they have decided to forfeit their purported shareholders in TTB and Union Bank of Nigeria irrespective of which vehicle that they are using to own the purported shares”.

“Should you (Lemo) also refuse to attend the meeting to provide additional statement to your earlier statement made in August 2023, it will be construed that you misled the Nigerian public with your reaction in the Punch Newspapers which has gained wide publicity in both electronic and print media”, stated the December invitation to the trio of Lemo, Savara and Vinks.

Some analysts say last night, that based on the expressions in the letter from the Panel, the trio are as good as being on the way to forfeiting their share holdings in both the embattled Titan Trust Bank and Union Bank of Nigeria.

The Jim Obazee investigation team had in a report he submitted to President Bola Tinubu on December 20,said the former governor of CBN, Godwin Emefiele, used “ill-gotten wealth” to establish TTB and used it to acquire Union Bank and Keystone Bank through some persons serving as his proxies.

According to part of the report, “The Special Investigator probed into the activities of the TTB and discovered that there is a mysterious shareholder who has given interest-free long-term loans (with no fixed repayment schedule) to the entities. The mysterious shareholder is believed to be Mr Godwin Emefiele.”

Meretrobusinessnews.com, (MBN) gathered that the federal government, through CBN is considering various options to stem the fast dwindling confidence in the banking industry occasioned by alleged corporate governance, insider abuses as well as foreign exchange rules violations by the Deposit Money Banks, (DMBS).

It was further gathered that based on the weighty allegations by the panel on alleged violations and abuses of office by the former CBN governor, most of the policy decisions and programs, like Mergers and Acquisitions already consummated as well as the sale of some entities would be reviewed, while those in the offing would be put on hold.

This is because president Tnubu had, directed Obazee, who was the chief executive officer of the Financial Reporting Council of Nigeria (FRCN) between 2011 and 2017, to take immediate steps to ensure the strengthening and probity of key Government Business Entities (GBEs) and block leakages in the CBN and related GBEs.

He also directed him to provide a comprehensive report on public wealth currently in the hands of corrupt individuals and establishments (whether private or public).

This is even as some key officers in some of the affected institutions were allegedly sidelined during some of the exercises, believed to be solely carried out by CBN and in some few cases, the Assets Management Corporation of Nigeria, (AMCON), the bad bank, which holds federal government’s equity holdings in trust until the embattled entities are disposed of.

Beside beaming searchlight on banks and their chief executives including members of the board, government is said to be miffed by TTB’s management claims that it sought and obtained all necessary regulatory approvals from its primary regulator –CBN, the Securities and Exchange Commission, the Nigerian Exchange Limited, and the Federal Inland Revenue Service, among others.

Federal Government, sources told MBN, would like to know why, for instance, the report of the investigation by the crack detectives from the Economic and Financial Crime Commission (EFCC), at the expense of Tax payers in 2022 0n the purchase of Union Bank by Titan Bank has not been made public up till this moment.

This will be in addition to reports from other federal government entities that were part of the approval processes for the concluded or ongoing exercises as claimed by the affected institutions.

MBN checks further revealed that it is not only Union bank and Titan Trust bank that are in neck-deep to wriggle out of the crisis, even after their preferred initial political option of solving it failed, top executives of banks and other influential Nigerians that have had dealings with any of the banks, which may not be ‘very transparent’ have started pulling their strings for either soft landing or be allowed to make some ‘quiet refunds.

Besides dispatching emissaries and powerful delegations by some boards of these entities to ‘powers that be’ to influence likely decisions on them in the event of full probe, either not to go beyond ‘what is in the public domain now or step it down outrightly,’ efforts are being made to clean ‘suspicious bad records and actions domiciled both within and outside the country.

“These are desperate and difficult period for some past and present board members of some banks, and what some are planning to do is to begin subtle laundering of their image to distract public attention from the past.” says a source who pleaded for anonymity.

Commenting on one of the transactions consummated during the tenure of Emefiele, former governor of CBN, a member of the board of one of the banks confided in MBN:

“You may not believe it. The transaction was solely handled by the Bank and AMCON. I understand the MD was not comfortable.

Unfortunately, Godwin did not handle his mandate professionally from all indications. May they take the correct decision in the interest of Nigerians.”

As if the many decades of gap between the acquirer, TTB of less than five years and acquired,UBN, one of the legacies from the colonial masters was not intriguing enough, ProvidusBank Limited, a commercial bank founded in 2016, recently commenced bold steps to acquire majority stake in Unity Bank Plc, an institution that commenced operations in January 2006, following the merger of nine banks with competences in investment, corporate and retail banking.

MBN gathered that the arrangement with Unity Bank that had been struggling to beef up its minimum capital requirement since 2017, and referred to as a business combination, was being monitored by the then Emefiele led CBN.

The proposed acquisition according to MBN sources had already received approval in principle from CBN’s Committee of Governors during Emefiele’s time in office.

The report stated that the leadership of both banks had almost concluded the deal and with the approval by the regulatory authorities, announcement was formally going to be made to the public, but the recent changes in the CBN may have slowed down the acquisition deal between the two banks of advancing the deal closer to a conclusion.

But a source familiar with the development insists that, it is a business combination as opposed to an acquisition.

Speaking in measured tone to MBN then, under strict anonymity, a source closer to Unity bank said,”negotiations are still going on.”

Pressed further, he said, “Discussions are ongoing, but it’s not an acquisition but business combination and still in the works.”

MBN gathered that some analysts are still asking questions about the practicability and workability of the said business combination as both banks seem to have different value propositions and historical antecedents.

But the development, coming after the 2018 failed move by Milost Global Inc., a New York-based private equity, to invest $ 1 billion in the bank, and similar one where one of Nigeria’s oldest financial institutions, Union bank, has allegedly being acquired by yet a younger bank, may have set tongues wagging on the seemingly paradigm shift and ‘swapping of positions in the industry.

It was further learnt that the beehive of activities in the economy in recent times have made both parties to have reduced the frequency of discussions, and possibly looking forward to other opportunities likely to be provided by the new CBN induced consolidation.

The analysts further argue that the recent ‘unusual happenings’ may be precursors to major reforms being contemplated by Tinubu presidency through the Jim Obazee investigative panel.

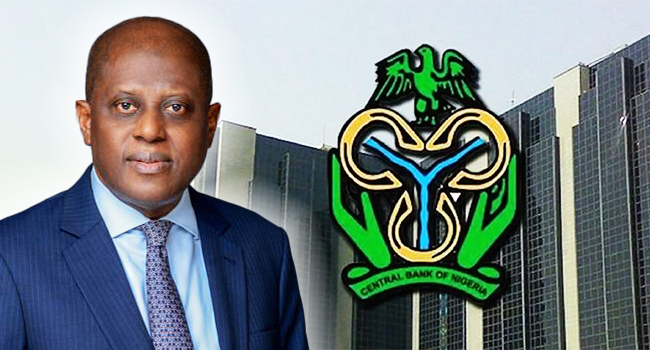

Consequently, Cardoso, CBN Governor recently announced plans to recapitalize banks in anticipation of achieving the Tinubu administration’s GDP size target of $1 trillion.

Speaking on the process of recapitalization, the CBN boss highlighted the crucial need for banks to be recapitalized, considering the substantial developmental role the apex bank anticipates them to fulfill over the next seven years.

ALSO READ:Obazee’s Special Investigation Panel On Collision Course With TTB, UBN Owners

His words:“Considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy. It is not just about the stability of the financial system in the present moment, as we have already established that the current assessment shows stability.

“However, we need to ask ourselves: Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1.0 trillion economy shortly? In my opinion, the answer is “No!” unless we take action. Therefore, we must make difficult decisions regarding capital adequacy. As a first step, we will be directing banks to increase their capital.”

This announcement has since sent ripples through the banking industry, reminding the operators events of 2004 when the Soludo-led Central Bank increased bank minimum capital requirement from N2 billion to N25 billion in a move called banking consolidation.

The decision at that time compelled numerous banks to merge, reducing the number of banks in the country from over 100 to just 25 by the end of the consolidation process.

It is almost about 20 years since then, and banks have substantially increased their shareholder funds as well as improved substantially on their share capital.

But while we have experienced a significant increase in shareholder funds, adjusting for exchange rate devaluation over the years suggests banks are not as strong in terms of capital at least in dollar terms.

Most analysts believe this is perhaps why the central bank is keen on increasing bank’s share capital in 2024, a development that may prove an upheal task for some banks, just like the achievement of the targeted $1.0 trillion GDP, based on the rate of growth presently.