John Danjuma Omachonu

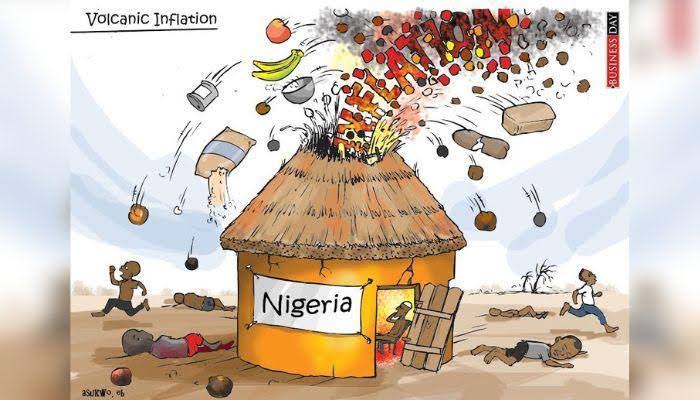

Nigeria’s economic climate is daily becoming tough as an average household is finding it extremely difficult to feed, due to high cost of living.

The implication is that the development has narrowed or completely removed survival options for households, who are now faced with the old dictum of ‘if the desirable is not available, the available should be desirable’.

According to the National Bureau of Statistics (NBS) inflation which plays a critical role in determining the cost of living among Nigerians, across the states, is currently at an 18-year high at 27.33 percent.

However, the burden of this rising inflation is felt differently across the country, making one state more expensive to live in than the other in the country, based on October 2023 all items inflation rate.

Consequently and based on the latest data from NBS, Kogi tops the first 10 states where life is becoming unbearable due to rising cost of goods and services, and particularly, food stuff.

The Confluence state is regarded as the most expensive state to live in Nigeria with an all-items inflation rate of 34.2%.

This represents a significant rise from the 28.5% reported in September.

More worrisome is the fact that the food inflation rate moved to 34.2%, suggesting that the spike in food prices is a major driver of the overall inflation in the state.

This places a heavy leadership burden on the new administration to ensure that critical infrastructure is provided to encourage farmers to transport farm produce to towns and cities within the state.

Regular and full payment of salaries will alleviate the suffering of the citizens as their disposable income will improve.

According to the report, Rivers is the second most expensive state with an all-items inflation rate of 31.4%. Food inflation is a bit lower at 29.3%, but the jump from September’s 27.0% all items inflation rate points to a growing trend of increased living expenses.

Lagos, the commercial heartbeat of Nigeria, also has an all-items inflation rate of 31.2%, with food inflation at 27.0%, considered too high for cosmopolitan state, regarded as state of excellence.

The slight increase from September’s all-items rate of 26.1% indicates a steady climb in living costs.

Oyo State trails Lagos with an all-items inflation rate of 31.2%. However, the food inflation rate stands out at a staggering 37.0%, the highest among the states listed, signifying a considerable surge in food prices compared to September’s 34.3%.

Midway on the list is Akwa Ibom, with a 30.7% inflation rate. Food inflation is particularly high at 31.3%, showing that the general increase in prices is heavily influenced by food costs.

Others include Ondo state which presents a slightly better scenario with an all-items inflation rate of 29.4%. This rate has held steady from September’s figures. The food inflation rate also remains constant at 27.7%, indicating a stable but high cost for food items.

Abia State’s inflation rate stands at 29.3%, but with significant food inflation rate of 33.2%, which is higher than the overall inflation, emphasizing the hefty cost of food in the state.

With an all-items inflation rate of 29.3%, Ebonyi State has seen a substantial rise from September’s 23.2%, with food inflation also high at 31.5%. This suggests a significant month-on-month escalation in the cost of living.

Bayelsa state, with an all-items inflation rate of 29.0%, experiences a notable jump from the 21.0% recorded in September.

However, despite this increase, the state recorded the lowest food inflation rate at 24.4%, suggesting a relatively lesser impact on the food sector.

With the lowest inflation rate among the ten listed states at 28.2%. Kwara still experience a noticeable increase from September’s 24.4%. The food inflation in Kwara is quite high at 31.7%, indicating that food prices are a significant part of the inflation dynamics in the state.

During the launch of the June 2023 edition of the Nigeria Development Update, the World Bank stated that Nigeria has one of the highest inflation rates, which pushed an estimated four million people into poverty between January and May 2023.

The global lender also said about 7.1 million poor Nigerians would become poor if the Federal Government failed to compensate or provide palliatives for them, following the removal of fuel subsidy, which has contributed significantly to inflationary pressures.

Generally, while some states experience a more pronounced increase in the cost of living, the trend of rising prices is a nationwide concern.

Also, the escalation in food prices remains a common thread, pointing to the need for interventions that can cushion the impact of inflation on the average Nigerian.

With such insights, stakeholders and policymakers can better strategize to tackle inflation and ease the financial burden on citizens across the country.

But, inflationary pressure remains persistent in the economy as households and businesses continue to grapple with high cost of living and operation.

This is supported by the CPI report, headline inflation at 27.33% y/y in October, 61bps higher than what was recorded in the prior month, as food and energy prices keep stoking unusually elevated inflation.

As per the norm, the food basket, which constitutes about 50.00% of overall CPI, was the major driver of inflation as food prices rose further to 31.52%, 88bps above 30.64% recorded in the previous month. According to details from the report, the rise in food inflation was propelled by increases in the prices of Bread and cereals, Oil and fats, Potatoes, Yam, and other tubers.

ALSO READBiden’s Xi Dictator Comments Extremely Wrong-China

MetroBusinessNews (MBN) reports that the consistent increase in food items may not be unconnected to the unabating security challenges in food producing parts of the country which has contributed to shortage of food supply in past months.

On the other hand, excluding volatile food and energy prices, the core inflation followed suit in the upward trend as the core index advanced to 22.58% y/y in October, 74bps higher than 21.84% seen in the preceding month.

The rise in core inflation can be largely attributed to the aftermath of the fuel subsidy removal which drove PMS prices significantly high to a range of N590 – N680 depending on the specific location. This is in addition to already elevated diesel prices, which is affecting aggregate cost of transportation and other needs.

According to Analysts at the Investment Management & Research, “going forward, we envisage further northward movement in inflation figures in the near to medium term which should be driven by higher cost of transportation and the persistent insecurity concerns affecting food production that has led to shortage of food supply across the Nation.

Food inflation is also expected to be pressured by exchange rate depreciation and in turn affect the prices of imported food. However, we expect the pace of increase in food inflation to be moderate even as month-on-month numbers slow down due to the current harvest season.”