The Nigerian Bar Association (NBA) says the Central Bank of Nigeria (CBN) is under statutory obligation to redeem the old N200, N500, and N1,000 banknotes after the January 31 deadline.

The apex bank has however remained unequivocal about its decision that only the redesigned currency will be legal tender after the date.

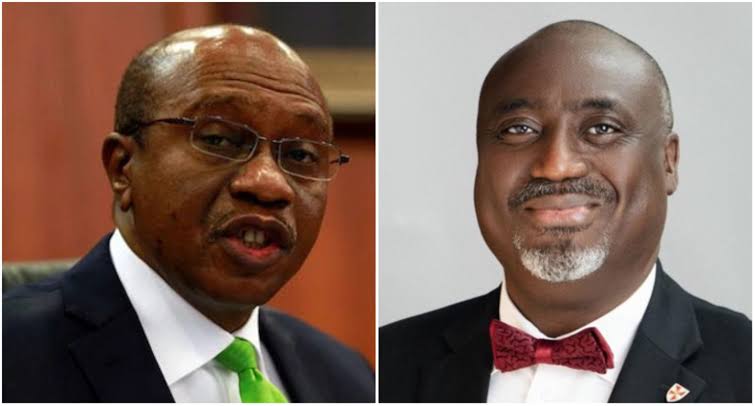

But the NBA President, Yakubu Maikyau, SAN, in a letter addressed to the CBN Governor, Godwin Emefiele, insisted that the law allows Nigerians to redeem their old naira notes at the CBN.

According to a statement by the NBA’s National Publicity Secretary, Akorede Lawal, on Saturday, Maikyau expressed what he described as telling concerns about the fate of Nigerians with the old currency past the January 31, 2023 deadline, saying, “The law is clear on this issue.”

He cited the provisions of Section 20 (3) of the CBN Act which he said provides that “notwithstanding Sub-sections (1) and (2) of this section, the Bank shall have power, if directed to do so by the President and after giving reasonable notice in that behalf, to call in any of its notes or coins on payment of the face value thereof and any note or coin with respect to which a notice has been given under this Sub-section, shall, on the expiration of the notice, cease to be legal tender, but, subject to section 22 of this Act, shall be redeemed by the Bank upon demand.”

The NBA President noted that “any person who shall be in possession of the old notes which have ceased to be legal tender by 31 January 2023 is at liberty to approach the CBN and demand for the redemption of the notes and the CBN is under statutory obligation to ‘redeem’ the notes.”

In view of the dearth of information in this regard, the NBA President added that “our recommendation, on this issue is that in addition to educating Nigerians on demonetisation itself, a campaign on what happens to old bank notes after 31 January should be launched so as to adequately inform the public on what to do and prevent or reverse the rising panic or agitations caused by concerns about the inability of Nigerians to swap their old notes for the new notes by 31 January.”

ALSO READ:UBA, Fidelity, Others Extend Workdays As CBN Insists On January 31 Deadline For Depositing Old Naira Notes

See Full Statement Below:

PRESS RELEASE

CBN DEMONETISATION POLICY:

*NBA PRESIDENT WRITES CBN GOVERNOR,

*MEETS MINISTER OF FINANCE,

*APPEALS FOR URGENT REVIEW OF POLICY,

*SAYS PRESIDENT BUHARI MAY HAVE BEEN WRONGLY ADVISED, INSISTS THE LAW ALLOWS NIGERIANS TO DEMAND CBN TO REDEEM OLD NOTES AFTER THE JANUARY 31 DEADLINE

In reaction to the demonetisation policy of the Central Bank of Nigeria (CBN) which directs that the old naira notes (N100, N200, N500 and N1000) will cease to be legal tender in Nigeria from February, 2023, the Nigerian Bar Association (NBA) has insisted that the law allows Nigerians to redeem their old naira notes at the CBN even after the January 31, 2023 deadline set by the apex bank.

The NBA has also appealed for the urgent review of the demonetisation policy of the CBN.

The NBA’s appeal is contained in a letter signed by the NBA President, Mr. Yakubu Chonoko Maikyau, OON, SAN and addressed to the CBN Governor, Mr. Godwin Emefiele.

While acknowledging that the policy is laudable as it has the potential to stem corruption, votes buying and other criminal activities, the NBA President noted that “the necessary logistical, infrastructural and manpower support, required for the successful implementation of the policy are in short supply and should be greatly improved upon if they are to be leveraged for full implementation of the policy with minimal loss or economic hardship.”

In the letter, the NBA President expressed the telling concerns that there is no information in the public domain as to what would happen to the old currency in possession of Nigerians, by or after the 31 January 2023, even as the law is clear on this issue. Quoting the provisions of Section 20 (3) of the CBN Act which provides that

“notwithstanding Sub-sections (1) and (2) of this section, the Bank shall have power, if directed to do so by the President and after giving reasonable notice in that behalf, to call in any of its notes or coins on payment of the face value thereof and any note or coin with respect to which a notice has been given under this Sub-section, shall, on the expiration of the notice, cease to be legal tender, but, subject to section 22 of this Act, shall be redeemed by the Bank upon demand”, Mr. Maikyau noted that “any person who shall be in possession of the old notes which have ceased to be legal tender by 31 January 2023 is at liberty to approach the CBN and demand for the redemption of the notes and the CBN is under statutory obligation to “redeem” the notes.”

In view of the dearth of information in this regard, the NBA President added that “our recommendation, on this issue is that in addition to educating Nigerians on demonetisation itself, a campaign on what happens to old bank notes after 31 January should be launched so as to adequately inform the public on what to do and prevent or reverse the rising panic or agitations caused by concerns about the inability of Nigerians to swap their old notes for the new notes by 31 January.”

In a related development, the NBA President on Friday paid a courtesy call on the Minister of Finance, Budget and National Planning, Dr. Zainab Shamsuna Ahmed in Abuja and relayed the concerns of the Nigerian people over the demonetisation policy of the CBN, particularly in view of the scarcity of the new notes and the difficulty Nigerians are encountering in swapping the old notes .

The NBA President informed the Minister that he directed the chairmen of the 128 branches of the NBA to survey and assess the impact of the policy on Nigerians in their respective jurisdictions and the aggregate of report thus far indicated that banking facilities are being overstretched and citizens are uncertain about the policy.

Mr. Maikyau noted that the worse hit are the under-privileged citizens whose life asset may not be up to N10,000 and who do not have access to the new notes and may therefore be denied of their hard earned money in the old naira notes.

The NBA President recalled that the Government ought to avoid the repeat of the harsh experiences of Nigerians in 1984 when a similar demonietisation policy reportedly claimed the life of a trader who committed suicide because he was stranded with about NGN 200,000 of the old notes.

While addressing the Minister, Mr. Maikyau stressed that “President Buhari may have been wrongly advised on the policy because by the provisions of the CBN Act the power of the CBN to call in any of its notes or coins otherwise described as demonetisation, can only become operational upon the directive of the President after giving reasonable notice for the recall.

From the clear wording of the section, these two conditions must coexist before the power to call any of the notes or coins by the CBN can crystallise. The questions that have trailed this policy from our consultations include; “was there a directive of the President? And where there was one, could it be said that the notice, given the prevailing circumstances was reasonable ? The questions seek to interrogate the process leading to the policy and justify the need for extension of the timelines for its implementation.”

Speaking of the condition of reasonable time as provided for in the law, the NBA President added that while the CBN for the first time announced the policy in October 2022, citizens have only been given a mere 45 days to swap naira notes, since the new naira notes only became available from December 15, 2022. Mr. Maikyau noted that when a similar policy was introduced in an advanced economy as United Kingdom’s, the government had announced a date for demonetisation 18 months in advance.

In her response, the Minister of Finance commended the NBA for being the first professional body to express concern over the issue, particularly as it relates to the provisions of Section 20 (3) of the CBN Act which allows Nigerians to approach the CBN to redeem their old currency notes even after the deadline. She added that the government is aware of the concerns over the policy and that the ministry would reach out to the CBN in a bid to consider revisiting the January 31 terminal date of the demonetisation policy.

Akorede Habeeb Lawal

National Publicity Secretary, NBA