The year 2022 cannot be forgotten in a hurry, particularly for buyers of naira assets like stocks and bonds.

It was another challenging year indeed as increased monetary policy tightening and flip-flop fiscal policies shaped decisions in selecting portfolio mix.

Generally, the capital market, initially, became worse of following developments in Nigeria’s macro economy and a weakened naira which made most investors to show lukewarm attitude towards naira assets.

However, recent developments show investors in the Nigerian equities market booking a N6.08 trillion gain in market capitalization as trading closed for the year on Friday, December 30, 2022.

It was the third consecutive year of gain despite unmitigated domestic and global headwinds that stunted economic growth.

After sustained ten days of a market rally, trading on the last day of the last week of 2022 closed in a bumper as the benchmark All-Share Index appreciated by 1.89 per cent, the largest single-day gain in the month to close at 51,251.06 points, the highest level since July 25.

These were propelled by positive showing by bank stocks, telecoms, oil & gas, and others sectors kept investors smiling home with unexpected year-end rallies.

But monetary hiking to fight inflation made most banks to reappraise the facilities to their customers, development that adversely affected production output of most firms.

While the banks continued to blame their action on CBN for the hike, Corporate and Individual customers suddenly found themselves between the devil and the red sea, hence the inevitability of upward review of interest paid on their deposits.

In spite of these challenges customers of banks in Nigeria, also plaqued by dearth of new naira notes, various charges, high interest rates, poor service, among others, have one more thing to worry about, particularly in the new year-securing enough foreign exchange for basic and personal traveling allowances as well as pay for school fees for foreign as well as online students.

They are also faced with sourcing enough FX for foreign components of production, a development tgst made some of them operate below capacity utilization.

The situation was is so bad that banks now ration the FX to customers, based on the meagre approval from the Central Bank of Nigeria, (CBN).

With the official exchange rate at N449. 05/$, as at December 30, 2022, according to the CBN website and unofficial exchange rate at about N750/$, there is huge gap to encourage roundtripping and other sharp practices allegedly by banks and CBN.

More worrisome is the fact that the country’s foreign exchange reserves fell 8.49 percent year-to-date to $37.07 billion on December 28 from $40.51 billion on January 4, this year.

Data from the CBN showed that the country’s foreign exchange reserves also declined -0.13 percent month-on-month from $37.12 billion on November 28, 2022.

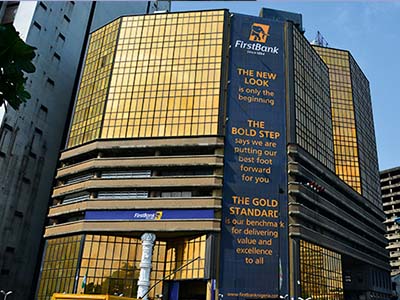

Specifically, FirstBank customers will have more to worry about as the bank has rolled out new conditions for foreign school fees.

According to a message to its customers, the new policy regarding foreign exchange transactions for school fees and maintenance allowance for international students will now require at least a 60-day processing period.

One of the implications is that customers’ ability to pay for services abroad and online has been hampered, amid currency shortage issues and the resulting effect on banks’ decisions to limit international transactions.

First Bank stated in a letter to its customers that processing school fees and upkeep for international students will take at least 60 days.

The bank also set a limit of $15,000 per semester and two semesters per session, with a maximum of $3,000 for foreign students.

“A minimum of 60 days is required for processing school fees and upkeep/maintenance, after the submission of documents along with the approved Form A at the branch.

“Payment of school fees is subject to a maximum of $15,000 per semester and limited to 2 semesters per session.

“Application for Upkeep is subject to a maximum of $3,000 (or its equivalent in other currencies) per Semester, limited to two semesters per session.

“Payment of school fees for the current session must be made through FirstBank for upkeep to be processed.

“Application for Form A for (School fees, Student Upkeep, and PTA/BTA) must be processed on the Central Bank of Nigeria’s Trade Monitoring System (TRMS) Platform and must be in line with Regulatory Requirements.

“Requests will continue to be processed and disbursed subject to the availability of FX,” First Bank said in the letter

Zenith Bank and the United Bank for Africa (UBA) similarly reduced international spending limits on their naira cards from $100 to $20 per month in February and March.

Standard Chartered Bank also suspended international transactions on its naira visa debit card in July.

Nigeria has been facing acute shortage of foreign exchange ocassioned by declining revenue from oil whose assets have been subjected to theft and vandalization in recent times.

This has resulted in the withdrawal of foreign portfolio investors from the economy as well as rising debts to fund budget deficits and even service the debts.

According to Bismarck Rewane in the current Economic Bulletin, “Sovereign debt management is becoming an onerous challenge for most sub-Saharan African countries. Some of these countries are at a high risk of debt distress, and are now calling the IMF for support programmes.

For example, the IMF has reached a staff-level agreement of $3 billion with Ghana to partially solve its debt problems, and Kenya has secured the Fund’s $447mn disbursement, totaling $2.4bn.

Meanwhile, Nigeria is facing both debt and revenue problems, with its debt-to-GDP ratio estimated at approx. 26% but below SSA average (56%). Could Nigeria be the next?.”

However, he said that “Nigeria’s GDP is projected to slow to an average of 2.8% in 2023 from 3.2% in 2022 due to high logistics costs, exchange rate pressures, low oil production, and high debt service costs.

That notwithstanding, interest rates are expected to stay elevated, whilst high inflation would moderate later in the year.

In addition, forex scarcity will linger until a change in forex policy by the new administration.

Meanwhile, fiscal imbalances and debt sustainability will remain focus areas of the new administration, especially as debt rescheduling discussions commence in Q4.”