Nigeria’s biggest power station shows the huge problems that President Muhammadu Buhari must overcome if he is to fulfil his promise to tackle chronic electricity shortages and reform an economy in recession.

On the outskirts of Lagos, three out of six turbines lie idle at the Egbin plant, starved both of gas due to militant attacks on pipelines that supply the station – and of funds that would allow its owners to buy alternative fuels and even implement an expansion plan.

Buhari won last year’s presidential election with pledges to increase power capacity exponentially during his four-year term and meet the demands of Nigeria’s 180 million people entirely within a decade.

But an upsurge of the attacks in the Niger Delta and acute foreign currency shortages are frustrating his ambitions, along with older problems of back payments owed by the federal government to power station operators and an ageing power grid.

Buhari wants to diversify the economy away from oil, sales of which account for two thirds of government revenue. But frequent power cuts and soaring fuel costs are forcing many manufacturers to shrink, not expand their businesses. This, along with falling crude production at a time of low global prices, is deepening Nigeria’s first recession in 25 years.

One such factory owner is Reginald Odiah, managing director of Bennet Industries which makes light fittings in Lagos.

Odiah, who set up the company in 1984, said he can no longer run his factory on the mains supply and instead has to use his own generators running on imported diesel, the price of which has soared due to a dive in the Nigerian naira currency.

“It makes me sick. It has run my business down,” he told Reuters, adding that his power costs have risen by around 50 percent over the last year. “If it continues the way it is going, we may have to close.”

Since January, Odiah has slashed his workforce from 150 to 18 and cut output to just three days a week. Now the factory switches to the generators for production runs because the national grid “fails you without notice”, he said, complaining of power cuts up to 10 times a day.

INITIAL SUCCESS

Nigeria needs 10 times its current output to guarantee reliable supplies for urban and rural inhabitants alike.

When he came into office in May last year, Buhari inherited a problem that has held back Nigeria’s economic development for decades. Despite holding the world’s ninth largest gas reserves, it reliably produces less than a tenth of the power that South Africa provides for a population less than a third of the size.

He had some initial success. Total power output rose from around 3,600 megawatts to a peak of 5,074.7 MW in February this year, according to the Nigeria Electricity System Operator.

But then the attacks by militants, who want more of Nigeria’s energy wealth directed to their impoverished southern swampland region, took hold. Output fell close to 1,400 MW in May – far from the leap to 20,000 MW within four years which Buhari’s party pledged in its manifesto for the 2015 elections.

The Niger Delta provides not only the bulk of the nation’s crude oil exports, but also the gas that powers Egbin’s generators about 300 km (180 miles) away in Lagos. A militant strike on a sub-sea pipeline that shut in oil production at the Forcados field in February also curbed the flow of gas to Egbin.

“Gas supply has been a major constraint for us from the standpoint of the Niger Delta crisis,” said Kola Adesina, the plant’s chairman.

Built in the 1980s, Egbin has a generating capacity of 1,320 MW, enough to provide a third of Nigeria’s electricity, and yet it is now producing just 606 MW.

Nigeria’s Sahara Group, which with South Korea’s KEPCO bought a 70 percent stake in Egbin when it was privatised in 2013, has plans to double its capacity.

But executive director Tonye Cole said in September that power tariffs did not cover its costs, and complained the government, via its bulk electricity purchaser, owed it huge sums. “We’re not going to pour in huge amounts of money until we can correct all these things,” Cole said.

Egbin’s owners say they are owed 90 billion naira ($295 million) in back payments. This is part of a much wider problem. According to the Association of Nigerian Electricity Distributors, total market revenue shortfalls were projected to be 809 billion naira by December 2016.

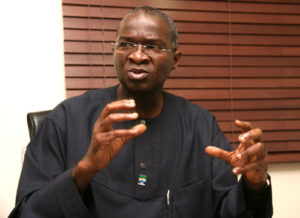

Minister of Power Babatunde Fashola says he is working with government colleagues, the president’s office and the central bank to resolve the problem of unpaid bills, some of which pre-date privatisation. “We will find a way … and ensure that going forward they will not accumulate again,” he said.

Still, the power generators face a litany of other problems linked to the industry’s structure. The bulk of their costs – including for gas, maintenance and imported spare parts – are in dollars but customers pay for the power in naira.

With Nigeria hard hit by the weak world oil market, the central bank effectively devalued the naira by 30 percent against the dollar in June. The power producers must therefore buy dollars with devalued naira income.

“The forex differential is huge,” Cole told Reuters.

Often the producers cannot find dollars at anywhere near the new official rate of 305 naira to the dollar due to the foreign exchange shortage that the devaluation was supposed to ease. The alternative is the black market, where the rate is around 460.

Egbin could run at least partly on fuel oil or liquefied natural gas brought in by ship, but all these problems mean the option is unfeasible at the moment.

RENEWABLE ENERGY STRATEGY

In the summer, the government agreed a ceasefire with the main militant groups in the Niger Delta. But with attacks resuming, it is unclear whether this will hold, highlighting the need to avoid relying so heavily on gas from the region.

Fashola said the long-term diversification plan is to develop a network of power plants funded by private investors, with a focus on solar power, hydro-electricity and wind farms.

Nigeria sealed its first solar power purchase deals in July, and has also signed agreements with the World Bank to add more than 500 MW of generating capacity.

The government needs $150 million of investment to provide electricity in rural areas alone through nine new gas and 28 solar plants with a combined capacity of 128 MW, Fashola said.

But even if Egbin and other plants operated at full tilt, the dilapidated transmission network could not handle the power. Rolake Akinkugbe, head of energy and natural resources at FBN Capital, said it “requires significant rehabilitation at least, due to system losses which result in up to 40 percent wastage”.

Experts estimate it would take $2.3 billion a year for a decade to expand grid access, which could probably be achieved only by partial or full privatisation. As yet the government has announced no clear plans to update the grid or attract private investment by selling the transmission company.